ISSN: 1204-5357

ISSN: 1204-5357

HANI EL CHAARANI

Beirut Arab University, Lebonon

ZOUHOUR EL ABIAD

Lebanese University, Lebanon

Visit for more related articles at Journal of Internet Banking and Commerce

This study examines the impact of technological innovation factors on the performance of Lebanese banks during an eight-year period (from 2010 to 2017). The research employed return on assets (ROA) and return on equity (ROE) as proxies to measure performance level. The technological innovation factors include internet banking, mobile banking, automated teller machines and investment in computer software. The technological innovation investment in automated teller machines (ATMs) and internet banking has positive impact on the performance of Lebanese banks. The results also reveal non-significant impact of mobile banking and investments in computer software on the performance of Lebanese banks.

Technological Innovation; Mobile Banking; Computer Software; Internet Banking; ATMs

Innovation is the application of new solutions that meet new and existing requirement, in articulated or existing market needs. This can be accomplished through new effective products, processes, services, technologies, or ideas that are readily available to markets, governments and society [1].

Nowadays, technological innovation is considered one of the most important tools that can affect the economic sector as well as the banking sector. DeYoung has forecasted that technological progress will destroy the models used in developing and delivering services in banks and will replace them with new and original ones [2]. Thus, banks should develop and adopt new technological innovation to perform in a highly competitive environment.

Hobe and Alas stated that innovation is one of the key profitability drivers of banks and, in the 21st century, it is becoming increasingly decisive in performance and competitiveness [3]. Beccalli has revealed that the investment in information technology and innovation has a significant impact on the performance of the banking sector [4].

Some researchers showed that the investments in internet and mobile banking can increase the bank’s performance [5,6]. Others have shown the positive impact of automated teller machines (ATMs) and point of sale terminals (POS) on the performance and the competitive advantage in the banking sector [7]. Therefore, the use of technological innovation, closely related to information and communication domains, is one of the most important factors in creating performance and competitive advantage in the banking sector.

By recognizing the significant aspect of technological innovation in the banking sector, the purpose of this research is to provide new evidence by addressing the following question: what is the impact of technological innovation on the performance of Lebanese banking sector?

In Lebanon, the banking sector is characterized by its high involvement in innovation. Most Lebanese banks have high standards of excellence in terms of technology, with high tech facilities, customer services and customer orientation, where all transactions and operations are computerized [8].

The Lebanese banking sector1 is constantly developing new methods of payments and remote banking systems to facilitate banking transactions. It has offered new delivery channels like Point of Sale terminals, mobile banking and Automated Teller Machines2. 93% of Lebanese commercial banks offer digital banking services (BLOMINVEST, 2016) and the number of cards issued by the banking system in Lebanon had reached 2.4 million in 2014 [9].

Despite the fact that Lebanese banks are highly affected by innovation, none of the existing researchers has studied the impact of technological innovation on the financial performance of Lebanese banks. Only a few researchers have studied the impact of technological innovation on the performance of Lebanese senior managers [10].

To bridge this gap, the main objective of this study is to investigate the impact of banking innovations on the financial performance of Lebanese banks by considering four forms of innovation: investments in mobile banking, internet banking, computer software and automated teller machines.

This research begins with a review of the theoretical and empirical literature related to innovation and bank performance. Secondly, it presents the research methodology employed to attain the objective of the study. Thirdly, it provides the empirical findings of the research and discusses them. Finally, it concludes with the results.

Innovation was primarily discussed by Joseph Schumpeter (1883-1950) between 1920s and 1940s. According to Schumpeter’s theory, innovation is an evolving cycle that begins with entrepreneurs who attract new entrants due to high profit opportunities, and thus a wave of investments occur which will reduce total profits.

Moreover, Schumpeter differentiated between entrepreneurs who create innovations and bankers who finance these innovations. Banks were characterized as “the monetary complement of innovations” which emphasis their role in credit-creation [11]. They should have the ability to evaluate whether a project will succeed or fail. Accordingly, they should deny credit for failing projects and finance those that are more likely to succeed. Schumpeter stressed the importance of bankers’ role in financing innovative ideas. However, the role of banks in this century is not only to provide credit for entrepreneurs but also to innovate by using new technologies to survive and stay competitive in a changing, complex and competitive environment. The financial activities in modern world cannot be executed without an advanced information system and updated technology because they are at the heart of the global change curve [12].

The use of information and communication technology in the banking sector could lead to deliver high quality services with less effort, and enhance banking performance in consequence [10,13,14]. Coraş, et al. have indicated that the changing needs of customers, the progress of technology and the pressure of competition force banks to look for new sources of competitive advantage, shifting their focus toward innovation [15].

Martim de Condo, et al. Indicate that technological progress and innovation have contributed to the development of the economy and businesses over the last decade [16]. For Ionescu and Dumitru technological innovation is the leading force of competitiveness and durable growth [17]. The author’s further state that innovation refers to the implementation of new technology, new working methods and new business models for the company.

Brem, et al. revealed the importance of technological innovation as a source for competitive advantage. They also showed that technological innovation is becoming the main factor of increasing the performance level [18].

Saeidizadeh, et al. revealed that the issuing of innovative methods in providing banking services is an essential factor in improving performance, attracting new customers and satisfying them [19]. The authors showed the importance of information and communication innovations as a key to success in a bank’s development. Hobe and Alas confirmed the importance of technological innovation as a determinant factor in the competitive advantage in banking sector [3]. However, they also stated that the success of innovation is becoming very complicated to measure in the service sector because it occurs throughout the organizational process.

For Abualloush, et al. innovation in information systems is vital for the banking sector. Accordingly, the investment in technological innovation creates a new working environment and increases the bank’s performance [20].

A real competitive advantage for banks is the ability to serve customers with a quick process that involves access to banking services with high security level and without any problem of customer defection. The mission of innovation is to attract new customers and satisfy the existing ones. Nowadays, the using of competitive intelligence and management of technology by the banking sector appears as important tools for success.

Kołodziej has proved that the implementation of augmented and virtual reality platforms in the banking sector generates competitive advantage and improves the effectiveness of banking activity [21]. This interactive model is currently used and tested by BNP Paribas and Citibank to meet the requirements of their customers and facilitate their decision-making process by creating images or events clarifying the different choices.

As a result, it appears that technological innovation is largely used by the banking sector to create competitive intelligence and competitive advantage because it helps banks to improve their services and their cost efficiency since fewer employees and less traditional branches are needed. It also decreases transaction costs by providing customers the needed capacity to execute their operations anywhere and anytime.

During the present period of globalization and technological progress, the banking sector has to upgrade its management system by using updated information and communication tools. Moreover, banks have to use technological innovation to improve their performance level by attracting new customers and satisfying them.

Many researchers have examined the impact of innovation on bank performance. The most used variables to measure performance level were the return on assets (ROA) and the return on equity (ROE). Technological innovation was measured by different variables such as investment in information services, existence of mobile services and internet services, investment in hardware and software, presence of cyber branches and number of ATMs.

The results of the different studies revealed a positive impact of some innovation dimensions on the performance of the banking sector. For example, Onay, et al. found a positive impact of internet banking on the performance of banks in Turkey between 1996 and 2005 [5]. The results of Alber showed a positive impact of phone banking on the performance of six banks in Saudi Arabia between 1998 and 2007 [22].

However, some researchers revealed a negative impact of investment in technology on the profitability level of banks. For example, Beccalli found a negative impact of investment in hardware and software on both ROA and ROE [4]. Jalal-karim and Hamdan revealed a negative impact of ATM numbers on banks performance [23].

Finally, some researchers were unable to find any significant impact of technological innovation on the performance of banks due to statistical constraints like the multicollinearity problem. Table 1 shows the results of different studies during different periods.

Table 1: The international evidence of the impact of innovation on bank's performance.

| Study | Variables | Results | |

|---|---|---|---|

| Dependent | Independent | ||

| Beccalli (2007) | -ROA | -IT to equity | -IT to equity: |

| (5 European countries, 1993-2000, 737 banks) | -ROE | -Computer hardware and software | Significant negative impact on short term ROA and ROE |

| -Cost efficiency | -Investments in | Significant positive impact on efficiency | |

| -Profit efficiency | IT services (consulting, training, implementation and support) | -Computer hardware and software investments: | |

| Negative impact on ROA, ROE and profit efficiency | |||

| -IT services: | |||

| Positive impact on ROA, ROE and profit efficiency | |||

| Onay et al. (2008) | -ROA | -Presence of internet banking | -Internet banking: |

| (Turkey, 1996-2005, 14 banks) | -ROE | -Deposits to total assets | Positive impact on performance. |

| -Return on financial intermediation margin | -Percentage change in GDP per capita | -Deposits to total assets and percentage change in GDP per capita: | |

| -Loans to total assets | Positive impact on all performance measures | ||

| -Bank crisis | -Loans to total assets and bank crisis: | ||

| -Lending rate | Negative impact on performance | ||

| -Lending rate: | |||

| Negative impact on ROA | |||

| Positive impact on ROE and return on the financial intermediation margin | |||

| Jalal-karim and Hamdan (2010) | -ROE | -Investment in software | -ROE model: |

| (Jordan, 2003-2007,15 banks) | -ROA | -Investment in hardware | Insignificant |

| -Earnings Per Share (EPS) | -Presence of phone banking | -EPS, MVA, ROA and NPM models: | |

| -Market Value Added (MVA) | -Presence of internet banking | Highly significant | |

| -Net Profit –Margin (NPV) | -Presence of SMS banking | ||

| -Presence of cyber branches | |||

| -Number of ATMs | |||

| Alber (2011) | -Actual ROA over best ROA ratio | -Number of branches | -Number of branches: |

| (Saudi Arabia, 1998-2007, 6 banks) | -Actual ROE over best ROE ratio | - Number of ATMs | Negative impact on ROE ratio |

| -Actual Return-On-Capital (ROC) over best ROC ratio | -Number of POS machines | Insignificant with the other two ratios | |

| -Presence of phone banking | -Number of ATMs: | ||

| -Presence of computer banking | Negative impact on all measures | ||

| -Presence of mobile banking | -Phone banking: | ||

| Positive impact on all measures | |||

| -Number of POS, the presence of both computer and mobile banking: | |||

| Insignificant impact on all measures | |||

Three dimensions of technological innovation have been considered in this study: mobile and internet banking, investment in computer software and finally, the implementation degree of ATMs. The other dimensions of technological innovation, such as Virtual Reality (VR) for example, are not considered due to their absence in the Lebanese banking sector (Figure 1).

The Investment in Mobile Banking (1D: First Dimension)

Mobile banking refers to provision of any type of financial and banking services with the help of mobile telecommunication devices distant from traditional branches. It includes a wide range of operations such as mobile application, SMS services, mobile statement and mobile payment. Some researchers consider mobile banking as an appendage of e-banking, whereas others consider it as a separate delivery channel.

Many scholars have reviewed the impact of mobile banking on bank’s financial performance. The Solow paradox, also called productivity paradox, is the main theory used to explain this relation. The theory suggests that IT investment has no positive impact on bank productivity and thus on bank performance. Solow has originated this theory after the slowdown of growth in productivity in US during 1970s and 1980s in spite of the fast development in IT [24]. However, the Solow paradox has been rejected in many studies. Wishart stated that mobile banking could lead to higher customer loyalty, increased market shares and declining operational costs [25]. This positive relationship was supported by many researchers at different significance levels [7,26].

Paradoxically, other researchers could not find any significant relationship between mobile banking and performance. According to Alber this insignificant relationship is attributed to two (2) main reasons. First, high perceived risk in mobile banking and low confidentiality. And second, low knowledge about different services in mobile banking [22].

As discussed previously, the impact of mobile banking on the performance of banking sector is highly examined in literature. The Solow paradox explains the insignificant and negative relationships. However, the majority of previous studies [7,25,26] have found opposite results. They have proved that mobile banking could lead to cost efficiency and higher bank’s performance.

Based on the previous discussion, this research considers that mobile banking positively affects banking performance: (H1) Mobile banking has a significant positive impact on bank performance.

The Investment in Computer Software (2D: Second Dimension)

Computer software is one of the essential components of Information Technology (IT) in the banking sector. It includes hardware, software and IT services. The impact of investment in computer software on bank performance has been widely discussed in literature.

Some researchers have focused on the importance of software investment on bank performance [23] whereas others have studied the impact of different IT components (hardware, software and IT services) on bank performance [4,6].

Beccalli confirmed the Solow paradox theory. She found that IT investment has no clear effect on EU bank performance measures (ROA, ROE and efficiency). She recommended that banks should decrease their investment in both hardware and software in order to increase their performance level [4].

Many other researchers have supported the Solow paradox theory by showing a negative or non- significant impact of IT investments on bank performance [27,28].

However, many other researchers have refused the Solow paradox theory. For example, Ben Romdhane found that investments in hardware, software and IT services provide a positive impact on bank efficiency [6]. Also, both Lichtenberg and Prasad and Harker have confirmed the positive impact of IT investment on the performance of the banking sector [29].

Chen and Zu advised the banking sector to increase their investments in IT services to raise their performance level. They considered the investment in IT services as a main factor in improving customer satisfaction [30].

As mentioned previously, there is a debate concerning the impact of investment in computer software on bank performance. The Solow paradox theory has explained the reason behind the unclear relationship between investment in IT services and bank performance. The empirical findings have showed that some authors support this theory [4,27,28], while others reject it by indicating a positive impact of investments in IT services on bank performance [6,29,30].

Since the majority of empirical results have found a positive impact, computer software is expected to positively affect bank performance: (H2) Investment in computer software has a significant positive impact on bank performance.

Investment in Internet Banking (3D: Third Dimension)

Internet banking can be defined as delivering of new banking products and services directly to customers through automated electronic channels. It involves many electronic operations such as funds transfer, printing of e-statements, exchange operations, electronic cards and electronic payments. Internet banking brings banks closer to their customers. It can improve the efficiency, quality and the speed in delivering customers services. Arnaboldi and Claeys have considered the internet banking system as an adequate strategy for banks with a large market share because they can spread labor costs on a big volume of deposit accounts.

For Dinh, internet banking leads to enhancing customer trust and loyalty. Beside these indirect impacts, some authors have indicated that internet banking can have a direct positive impact on bank performance, income and profitability [31].

Furst, et al. found that internet banks outperform non-internet banks in the United States during 1999 [32,33]. They indicated that the internet banks had more capacity to reduce their costs by increasing the internet services. DeYoung confirmed the positive impact of internet banking in the American market. He showed that the implementation of internet banking had a positive impact on the assets growth of more than 400 banks [34]. He also showed that internet banking increased bank revenue from deposit service charges.

Hassan et al. studied the impact of using internet banking on the performance of 105 Italian banks. After dividing their sample to two sub samples (users and non-users of internet banking), they found a positive impact of internet banking on profitability. Also, they showed a higher bank performance for the users of an internet banking system than that of non-users of an internet banking system.

The same results have been observed in the Spanish banking sector. Based on a sample of 72 banks, Hernando and Nieto revealed that the use of an internet banking system has a positive impact on the performance level (ROA and ROE) and a non-significant impact on the risk level [35].

By using structural equation modeling, Doust and Tehrani found that the use of internet banking has a significant relationship with commitment, trust and customer attraction in Iranian banks [36].

Recently, Barasa, et al. has studied the impact of internet banking by using quantitative and qualitative methods in Kenya [37]. They have recommended enhancing internet banking because the evidence has established a positive impact of internet banking on financial performance. In the same context, Okiro and Ndungu had found that the adoption of internet banking has enhanced the efficiency, effectiveness and productivity of financial institutions in Kenya [38].

However, many researchers have refused the positive impact of internet banking on performance level. They consider that the investment in internet banking enhances customer satisfaction but lowers the marginal profit.

Different results were provided from the Indian market, the study of Malhotra and Singh revealed a non-significant relationship between internet banking and bank performance for 46 Indian banks [39]. Jayaram and Prasad confirmed the nonsignificant association between performance and internet banking by providing a new evidence of the non-significant relationship [40].

Also from the Australian context, Sathye showed that the internet banking variable has no impact on the performance of major banks [41].

Based on the empirical results mentioned above, a positive impact of internet banking is expected on bank performance: (H3) Investment in internet banking has a significant positive impact on bank performance.

Investment in ATMs (4D: Fourth Dimension)

ATM is a computerized teller machine that provides a bank’s customers 24/7 access to different types of financial transactions without direct contact with a bank teller. It is an electronic fund transfer terminal capable of facilitating the access to cash withdrawal, cash deposits, money transfers and accounts inquiries. ATM is considered as the most used channel by bank customers. The number of ATMs over the total number of branches has increased very sharply during the last decade.

The existence of many ATMs over a large dispersed area makes customers more satisfied since they are able to access their bank accounts from any location at any time. Jeon indicated that customers choose a bank if their ATMs are located within their vicinity [42]. Joseph and Stone argued that the customer satisfaction level is influenced by the number of reliably functioning ATMs [43]. Therefore, banks have an interest in developing a large network of ATMs to attract more customers and satisfy them.

For many authors, ATM systems are believed to have a positive impact on bank efficiency and customer service. It is considered an efficient way to achieve high productivity and service levels at a very low cost. Monyoncho found that ATM innovations provide the banking sector in Kenya an excellent opportunity to enhance performance and increase loyalty among customers. The findings of Monyoncho also revealed that ATM system has the capacity to lower costs and maximize productivity [44].

Mwatsika supported the idea that the investments in new ATMs models and technologies can offer very competitive services [45]. Bamdad and Rafiei found that the ATMs quality has a significant impact on bank performance [46]. Their results indicate that customers prefer to use ATMs rather than referring to bank staff. Khan revealed the advantages of introducing telecommunication technologies in the banking sector [47]. In his study, he confirmed the positive impact of ATM service quality on customer satisfaction in Pakistani banks.

Based on a self-administrated questionnaire, Mwatsika found that the use of accessible ATMs predicts 40% of customer satisfaction in Malawi banks. In other words, his results confirmed the positive impact of ATMs on bank performance and the satisfaction level of customers [45]. The same positive impact of ATMs has been detected in Ghana by Boateng, et al. the researchers revealed a positive impact of the enhancement of ATM quality services on customer’s satisfaction levels [48].

Since the majority of empirical results revealed a positive impact of ATMs, the research supports the idea that the investment in ATMs has a positive impact on bank performance: (H4) Investment in ATMs has a significant positive impact on bank performance.

This section explains the data collection process, defines the variables and discusses the methodology used to reveal the impact of technological innovation on the performance of the banking sector in Lebanon.

The Selected Population and Sample

According to the Lebanese central bank database, there are 49 commercial banks in 2018. 32 Lebanese banks, 7 Arab-controlled Lebanese banks, 7 Arab banks and 3 foreign banks. Foreign, Arab and mixed-owned banks were excluded to ensure uniformity of the sample.

A non-probability sampling was used in order to select 17 banks. As a result, the sample represents 53.125% (17/32) of the total population. Some Lebanese-owned banks were excluded due to lack of information in their annual reports. The total assets of the sample represent 88.78% of the total assets of Lebanese-owned banks in 2015 [49]. Accordingly, the sample size is appropriate to represent Lebaneseowned commercial banks.

Table 2 below presents the banks of the study along with their frequency and percentage of observations. And Table 3 below shows the distribution of bank-year observations between 2009 and 2015.

Table 2: The sample of the Lebanese commercial banks.

| Banks | List of Abbreviation | Frequency of bank/year observation Between 2009 and 2015 | % of observation |

|---|---|---|---|

| Audi Private Bank S.A.L | Audi | 7 | 6.25% |

| Bank Beirut and Arab Countries S.A.L | BBAC | 7 | 6.25% |

| Bank Libano-Commercial S.A.L | BLC | 7 | 6.25% |

| Banque Libano-Française S.A.L | BLF | 7 | 6.25% |

| BLOM Bank S.A.L | BLOM | 7 | 6.25% |

| Bank Of Beirut S.A.L | BOB | 7 | 6.25% |

| Byblos Bank S.A.L | Byblos Bank | 7 | 6.25% |

| Credit Bank S.A.L | CB | 4 | 3.58% |

| Crédit Libanais S.A.L | CL | 7 | 6.25% |

| Fenicia Bank S.A.L | Fenicia Bank | 7 | 6.25% |

| First National Bank S.A.L | FNB | 7 | 6.25% |

| FRANSABANK S.A.L | Fransabank | 7 | 6.25% |

| Intercontinental Bank of Lebanon S.A.L | IBL | 7 | 6.25% |

| Jammal Trust Bank S.A.L | JTB | 7 | 6.25% |

| Lebanon and Gulf Bank S.A.L | LGB | 5 | 4.46% |

| Middle East and Africa Bank S.A.L | MEAB | 5 | 4.46% |

| Société Générale de Banque au Liban S.A.L | SGBL | 7 | 6.25% |

| Total observations | 112 | 100% | |

Table 3: The distribution of Bank-Year observations over the period of 2009 to 2015.

| Frequency of bank year observation | % of bank year observation | ||

|---|---|---|---|

| Year | 2009 | 14 | 12.5 % |

| 2010 | 14 | 12.5 % | |

| 2011 | 16 | 14.2 % | |

| 2012 | 17 | 15.2 % | |

| 2013 | 17 | 15.2 % | |

| 2014 | 17 | 15.2 % | |

| 2015 | 17 | 15.2 % | |

| Total | 112 | 100 % | |

The Identification of the Data Sources and the Variables

The study has used a secondary and unbalanced panel data collected between 2009 and 2015. Many sources were mobilized in order to collect all the data needed for the empirical study. The data of mobile banking application was collected from App Store and/or Android. However, the data for performance, investment in computer software and control variables were extracted from banks’ annual reports and Bankscope database. The ATMs data was collected from the Central Bank of Lebanon and finally, the internet banking data was extracted from the websites of the various banks [50-55].

Table 4 below presents the definition of dependent, independent and control variables. It also provides the significance of each variable.

Table 4: The variables used in previous studies and their significance.

| Variables | Indicator | Proxy | Significance | |

|---|---|---|---|---|

| DEPENDENT | PERFORMANCE | Return On Assets (ROA) |

|

Higher ROA indicates higher performance. |

| Return On Equity (ROE) |

|

Higher ROE indicates higher performance. | ||

| INDEPENDENT | INNOVATION | Mobile Banking (MB) |

Dummy variable: 0 if there is no MB 1 if there is MB |

If the bank has high innovation through a mobile banking application (MB=1), otherwise, MB=0 |

| Internet Banking (IB) | Dummy variable: 0 if there is no IB 1 if there is IB |

If the bank has high innovation through a internet banking application (IB=1), otherwise, IB=0 | ||

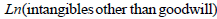

| Investment in computer software (ICS) |  |

Higher ICS indicates higher investment in innovation | ||

| Implementation degree of ATMs (ATM) | Number of ATMs | Higher number of ATMs indicates higher investment in innovation | ||

| CONTROL VARIABLES | BANK SPECIFICITIES | Capitalization (CAR) |  |

Higher CAR indicates higher bank capitalization |

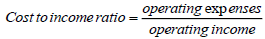

| Cost efficiency (EFF) |  |

Higher EFF indicates lower cost efficiency | ||

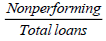

| Asset Quality (AQ) |  |

Higher AQ indicates lower asset quality | ||

| Bank Size (SIZE) | Ln(TotalAssets) | Higher SIZE indicates higher bank size | ||

The technical analysis

The impact of technological innovation on the performance of the Lebanese banking sector was tested by using a quantitative method. This technique includes both descriptive statistics and multiple regression analysis.

The following two models were regressed to determine the nature of relationship and the significance between bank performance and technological innovation:

Where:

• "ROA" and "ROE" : performance in bank "i" for period"t" .

• " α " : Y-intercept.

• " β ": coefficient of variable where "i" ranges from 1 to 8.

• " MBi,t " : mobile banking in bank "i" for period "t" .

• " ICSi,t " : investment in computer software in bank "i" for period"t" .

•" IBi,t " : internet banking in bank "i" for period "t" .

•" ATMi,t" : implementation degree in ATMs in bank "i" for period"t" .

•" CARi,t " : capitalization in bank "i" for period"t" .

•" EFFi,t " : cost efficiency in bank "i" for period"t" .

•" AQi,t " : asset quality in bank "i" for period"t" .

•" SIZEi,t " : size of bank "i" in period"t" .

• " ε " : error term.

In this section, the descriptive statistics are shown, than the regression results are presented and discussed.

Descriptive Statistics

The descriptive statistics are performed in order to have a preliminary understanding of bank’s characteristics enrolled in the sample. The focus of this research is mainly on the mean, which measures the central tendency, and the standard deviation, which measures the dispersion.

This table shows the results of the descriptive statistics of the dependent and independent variables. Dependent variables are Return-On-Assets (ROA) calculated by net income to total assets ratio and Return-On-Equity (ROE) calculated by net income to total equity ratio. The independent variables are; Mobile Banking (MB), a dummy variable which takes the value of 1 if the bank has a mobile banking application and 0 otherwise; Internet Banking (IB), a dummy variable which takes the value of 1 if the bank has an internet banking application and 0 otherwise; (ATMs) variable measures the number of ATMs and Investment in Computer Software (ICS) measured by natural logarithm of intangibles other than goodwill. The control variables are: Capitalization (CAR) measured by equity to assets ratio; Cost Efficiency (EFF) measured by cost-to-income ratio; Asset Quality (AQ) calculated by nonperforming loans to total loans ratio and Bank Size (SIZE) measured by natural logarithm of total assets.

The results of Table 5 show that mobile banking (MB) has a mean of 0.38 whereas internet banking (IB) has a mean of 0.66, which indicates that internet banking is more developed in the Lebanese banking sector. Nowadays, the majority of Lebanese banks offer their customers the internet banking services and facilities whereas mobile banking is still not well developed.

Table 5: The descriptive statistics.

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| MB | 112 | 0 | 1 | .3801 | .398 |

| ICS | 112 | .0000 | 11.1096 | 5.4627 | 3.1257 |

| IB | 112 | 0 | 1 | .6604 | .3964 |

| ATM | 112 | 9 | 474 | 87 | 48 |

| CAR | 112 | .0496 | .1232 | .0939 | .0128 |

| EFF | 112 | 31.7000 | 83.8000 | 51.401 | 11.6287 |

| AQ | 112 | .0010 | .2128 | .0222 | .0399 |

| SIZE | 112 | 13.0982 | 17.5595 | 15.421 | 1.1101 |

| ROA | 112 | .0017 | .0162 | .0106 | .0032 |

| ROE | 112 | .0182 | .1859 | .1233 | .0254 |

| ValidN (listwise) | 112 |

The average number of ATMs in Lebanon indicates that Lebanese banks have the tendency to develop their ATMs network over large and dispersed area. However, the maximum number of ATMs (474) shows that some banks have a greater tendency to invest in technological innovation. Moreover, this huge number of ATMs per bank may be due to bank size and regulations related to bank-size/ATMs fixed by the Lebanese Central Bank.

The natural logarithm of investment in computer software (ICS) confirms the tendency of Lebanese banks to invest in technological innovation. The results show that (ICS) has a mean of 5.46. In other words, Lebanese banks spend on average USD 235,599 on their computer software3.

As for the dependent variables, the results show that the average return on assets (ROA) is 0.0106 and the average return on equity (ROE) is 0.1233. By comparing these results with the averages of the banking sector across Middle Eastern countries, it appears that the averages of ROA and ROE in the Lebanese banking sector are higher than that of many other banking sectors in the region4. These results can reflect the performance level of the Lebanese banking sector in the region.

The descriptive statistics of control variables shows that the Lebanese banks are well capitalized because the average capital value represents 9.39% of the total assets. They have the capacity to manage their operational costs since the operational costs represent 51.401% of the operational revenue. Finally, they can easily manage and control their loans since non-performing loans does not exceed 2.22% of total customer loans.

In this section, the Weighted Least Squares (WLS) regression analysis is performed to test the impact of technological innovation factors on the performance of the Lebanese banking sector between 2009 and 2015. Before running the regression, two tests were applied. Both (χ2) and (F) values indicate the absence of heteroscedasticity evidence.

This table shows the results WLS regression analysis for Model 1 and 2. Model 1: Dependent variable is Return-On-Assets (ROA) calculated by net income to total assets ratio. Model 2: Dependent variable is Return-On-Equity calculated by net income to total equity ratio. The independent variables are: Mobile Banking (MB), a dummy variable which takes the value of 1 if the bank has a mobile banking application and 0 otherwise; Internet Banking (IB), a dummy variable which takes the value of 1 if the bank has an internet banking application and 0 otherwise. (ATMs) variable measures the number of ATMs and Investment in Computer Software (ICS) measured by natural logarithm of intangibles other than goodwill. The control variables are: Capitalization (CAR) measured by equity to assets ratio; Cost Efficiency (EFF) measured by cost-to-income ratio; Asset Quality (AQ) calculated by nonperforming loans to total loans ratio and Bank Size (SIZE) measured by natural logarithm of total assets.

The results of Table 6 show a non-significant impact of mobile banking (MB) on the performance level in the Lebanese banking sector. These results reveal that innovation through MB cannot be used to increase the performance of Lebanese banks since it needs a high level of human and financial investment and provides low income margins. Even though the investment of Lebanese banks in mobile banking reflects the high level of modernization, the low confidentiality level and high perceived risk on the part of a bank customer lead to minimize its impact on bank performance.

Table 6: WLS results5.

| Model 1: dependent variable ROA (net income to total assets) | Model 2: dependent variable ROE (net income to total equity) | |||

|---|---|---|---|---|

| Standardized Coefficients | Sig. | Standardized Coefficients | Sig. | |

| Beta | Beta | |||

| (Constant) | .002*** | .000*** | ||

| MB | -0.098 | .1622 | -0.106 | .213 |

| ICS | .222 | .311 | .301 | .298 |

| IB | .013 | .000*** | .009 | .000*** |

| ATMs | .141 | .000*** | .136 | .000*** |

| CAR | .166 | .010*** | .215 | .000*** |

| EFF | -0.560 | .000*** | -0.558 | .000*** |

| AQ | .074 | .257 | .056 | .320 |

| SIZE | .112 | .152 | .079 | .125 |

| R-square | 53.2% | 48.3% | ||

| Adjusted R-square | 54.5% | 52.4% | ||

| F statistic | 32.241 | 39.131 | ||

| Model significance P-value | .000 | .000 | ||

Levels of significance: ***1% , **5% and *10%

The investment in computer software (ICS) has non-significant impact on the return on assets and the return on equity of Lebanese banks. The results confirm the Solow paradox theory in which the investment in IT has no positive impact on bank performance. From these results, it seems that the investment in computer software can improve the control system and productivity of employees without having a direct impact on the competitive advantage and performance of Lebanese banks.

The existence of internet banking (IB) and a large number of automatic teller machines (ATMs) have a positive impact on the performance in the Lebanese banking sector. The results of Table 6 show positive significant impact of (IB) on return on assets (0.013) and return on equity (0.009). Moreover, positive significant impact of (ATMs) has been detected on return on assets (0.141) and return on equity (0.136).

Nowadays, many Lebanese banks are trying to improve their internet banking system and develop their ATM network because these two technological innovation tools are extensively used by bank customers. In consequence, they lead to improve bank’s financial performance and create a competitive advantage.

Finally, two control variables have a significant impact whereas two others have no significant impact. The results show a non-significant impact of bank size and asset quality ratio on the performance in the Lebanese banking sector. Oppositely, the coefficients of Capitalization (CAR) and cost efficiency (EFF) have a significant impact on bank performance. Also, Table 6 indicates that (CAR) has a significant positive impact on ROA and ROE and (EFF) has a significant negative impact on ROA and ROE. Accordingly, to increase their performance, Lebanese banks have to raise their equity level and control their operational costs.

Tables 7 and 8 below provide a summary of the results analyzed above. Two hypotheses are not rejected and two others are rejected. In this study, the results reject both H1 and H2 and reveal a non-significant impact of investments in mobile banking and Computer Software on bank performance.

Table 7: The hypotheses validation for Model 1 (dependent ROA).

| H | Variable | Expectation | Actual relationship | Rejection |

|---|---|---|---|---|

| H1 | Mobile Banking (MB) | + and significant | - and non- significant | Yes |

| H2 | Investment in Computer Software (ICS) | + and significant | + and non-significant | Yes |

| H3 | Internet Banking (IB) | + and significant | + and significant | No |

| H4 | Investment in ATMs (ATM) | + and significant | + and significant | No |

Table 8: The hypotheses rejection for Model 2 (dependent ROE).

| H | Variable | Expectation | Actual relationship | Rejection |

|---|---|---|---|---|

| H1 | Mobile Banking (MB) | + and significant | - and non-significant | Yes |

| H2 | Investment in Computer Software (ICS) | + and significant | + and non-significant | Yes |

| H3 | Internet Banking (IB) | + and significant | + and significant | No |

| H4 | Investment in ATMs (ATM) | + and significant | + and significant | No |

Only H3 and H4 are not rejected. This means that the investments in internet banking and ATMs have positive impact on the performance in the banking sector.

Examining the impact of technological innovation on the performance of Lebanese banks is crucial for bankers, investors and even customers. Nowadays, technological innovation in the banking sector is very important because it can be used to improve profitability and provide a new competitive advantage. Innovation is relevant also for customers because it can be used as a tool to ease, accelerate and simplify the different types of bank’s operations.

Using data of 17 Lebanese-owned commercial banks from 2009 to 2015, this research focused on the impact of investments in internet banking (IB), automatic teller machines (ATMs), mobile banking (MB) and computer software (ICS) on return on assets (ROA) and return on equity (ROE). Four control variables were also included in the study, namely capitalization (CAR), cost efficiency (EFF), asset quality (AQ) and size (SIZE).

The findings of the study revealed a positive impact of investment in internet banking and ATMs on bank performance. In Lebanon, the decision to be a new bank customer depends on the existence of an innovative internet banking system and the number of ATMs in customer’s vicinity. Lebanese customers rely on ATMs and internet banking instead of visiting branches.

Banks should spread their ATMs in different locations to be easily accessible by customers. At the same time, banks should control their ATMs system to guarantee a high level of performance, speed, security and reliability of services. Additionally, Lebanese banks should continue upgrading their internet banking to ensure an efficient up-to-date system for effective service delivery.

Both mobile banking and investment in computer software had no significant impact on the performance of the Lebanese banking sector. These results revealed that the investments in mobile banking and computer software face various challenges, among them the high investment costs and low direct utility of MB and ICS for customers.

Currently, Lebanese banks are required to invest in MB and ICS to be up-to-date and to reflect a minimum level of technological modernization. However, the Lebanese customers are not willing to use mobile banking due to privacy issues and low level of awareness about its utility. These challenges can be solved by educating customers to the use of mobile banking after providing them the needed information and facilities of processing. In addition, Lebanese banks have to consider effective methods to advertise their technological services and keep focusing on the present generation and the younger people who are more into mobile applications.

Finally, the results of the study have different limitations related to sample size, types of data and variables. Firstly, data was collected from only 17 Lebanese-owned banks which represent 53% of Lebanese banks. Secondly, the collected data was only in a consolidated form taken from consolidated financial statements over seven (7) years period for each bank. Thirdly, the list of banking innovations included in the study is not exhaustive. Other factors could be included and, consequently, this may alter the results of the study.

1The Lebanese banking sector plays a key role in the Lebanese economy and dominates the financial system (EL-Chaarani, 2014).

2The number of ATMs reached 1,597 in 2014, distributed all around Lebanese territory (ABL, 2014). Moreover, according to World Bank (2017), the number of ATMs (per 100,000 adults) in Lebanon was higher than the average in Middle Eastern countries between 2009 and 2014.

3Since we are considering the natural logarithm of the investment in computer software, thus the amount spent on software is equal to e5.4627= 235.599 thousand USD.

4Refer to the World Bank website.

5Table 6 shows that both models 1 and 2 are highly significant since p-value is equal to 0.000. Adjusted Rsquares for models 1 and 2 are respectively 61.3% and 71.8%. This means that 61.3% of variations in ROA and 71.8% of variations in ROE are explained by the variables studied.

Copyright © 2025 Research and Reviews, All Rights Reserved