ISSN: 1204-5357

ISSN: 1204-5357

By Kalyan Chakravarthy Bondugula, Akash Maiti

Email: Kalyan_Bondugula@infosys.com, Akash.Maiti@infosys.com

Kalyan Chakravarthy Bondugula

Kalyan has more than four years of management consulting experience specializing in Banking and Capital Markets. His focus areas include IT Strategy, IT Architecture, Package Evaluation & Selection, Strategic Sourcing and emerging technologies like Web Services. He has co-authored a thought paper on "Improving Operational Effectiveness for Banks" which is available on the Infosys website. Prior to joining Infosys, Kalyan worked with McKinsey & Company in their Business Technology practice.

Akash Maiti

Akash has over eleven years of professional and consulting experience in Banking and Capital Markets. He has developed expertise in the areas of IT and Business Strategy, Business Process Reengineering, and Program Management, and has led programs through all stages of the project lifecycle, including strategic planning, process redesign, requirements analysis and solution development and deployment for Global 500 clients. Prior to joining Infosys, Akash worked with Accenture and KPMG

Visit for more related articles at Journal of Internet Banking and Commerce

"The Society for Worldwide Interbank Financial Telecommunication (S.W.I.F.T.) is a Brusselsbased, member-owned body that aims to provide low-cost, competitive financial processing and communication services while maintaining high levels of quality, integrity, reliability, and security. SWIFT has been relatively successful in meeting the expectations of its members. However, rapid disruptive changes in technology have facilitated emergence of a new breed of challengers. This has forced SWIFT to react quickly and adopt a new strategic posture to not only retain its dominant position in the banking messaging space but also improve its position in securities and corporate messaging markets This paper analyzes the offerings of various players who are competing with SWIFT and discusses the potential implications for various customer market segments"

The Society for Worldwide Inter-bank Financial Telecommunication (S.W.I.F.T.) is a Brussels-based, member-owned cooperative society whose aim is to work with its member-bank owners and participant users as a partner to provide low-cost, competitive financial processing and communication services while maintaining a high level of service quality.

Since its establishment in 1973 by a Consortium of 239 North American and European banks from 15 countries, the Co-operative has helped automate financial transaction processes and participated in several worldwide industry initiatives to improve the message transaction process. As messaging volumes passing through its network continue to rise, SWIFT is preparing itself for the challenges facing the global financial industry.

SWIFT's portfolio of services and solutions spans the entire financial transaction lifecycle. It provides messaging and transaction processing services to the following markets:

• Payments: covers the needs across the transaction life-cycle from payment initiation and processing to reporting, exceptions and investigations. This accounts for the largest chunk of messages on the SWIFT network with about 60% of the volume in 2003

• Securities: provides services from pre-trade through to settlement and custody services. SWIFT is looking at this segment as a key driver for future growth and this is the fastest growing segment , primarily driven by the clearing and settlement messages

• Treasury and Derivatives markets: from confirmation, messaging, matching, to bilateral/multilateral netting, it provides all relevant messaging services

• Trade finance: through its Trade Services Utility, SWIFT facilitates electronic transmission of trade documents

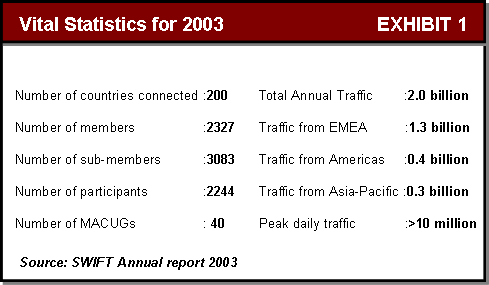

In 2003, SWIFT had one of its strongest financial performances, with traffic growth of 12.7% compared to 2002. Its yearly traffic reached the two billion message mark in 2003 and in June 2004, SWIFT passed the 10 million messages per day mark.

Inspite of these seemingly good results, SWIFT is under severe pressure due to -

• Increased competition

• Emerging technology standards

• Increased regulations and

• Changing customer requirements

Of the above, there is a high impact due to increased competition from various players.

This paper analyzes the offerings of various players who are competing with SWIFT and also discusses the potential implications for various institutions such as banks, asset managers and broker dealers.

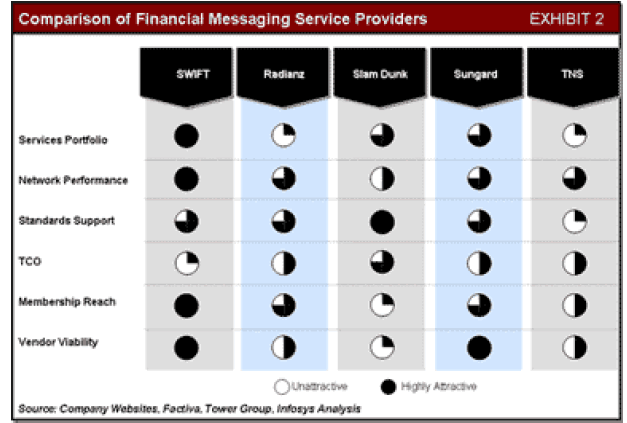

SWIFT faces strong competition from numerous vendors as it provides messaging services to multiple segments of financial services. With IP based messaging services becoming much more reliable and secure; the whole business dynamic of messaging services has undergone a paradigm shift. Financial institutions have much more choices now than couple of years before. . Of these, the players with potential to disrupt SWIFTs competitive positioning include Radianz, Sungard, TNS, Slam dunk etc. Exhibit 2 contains a detailed analysis of the various offerings as compared to SWIFT.

TCP-IP based networks such as slam-dunk networks are attaining maturity and their security standards have improved tremendously. Slam Dunk is a relatively new company but it already has a marquee customer in American Express, which has chosen them as a leased-line replacement for a large portion of their financial transactions.

Additionally, for FIX related messages, there are few credible options in Radianz and TNS. For all the Sungard shops, Sungard Transaction Network offers a very credible alternative: ease of connecting, support for industry standard financial protocols, including FIX, S.W.I.F.T., and XML and wide ranging services in equities, fixed income and post trade services.

SWIFT has to react quickly to the changes and adopt a new strategic posture to not only retain its dominant position in the banking messaging space but also improve its position in securities and corporate messaging markets. To its credit, SWIFT is making all the right moves within the few degrees of freedom its top management enjoys.

• Upgrade to IP network: SWIFT has started to upgrade its old network to a new network called SWIFTNet, which is a private, secure network that uses standard TCP/IP Internet protocols. This is distinct from the public Internet and available only to SWIFT members. SWIFTNet‘s use of standard protocols greatly simplifies the task of interfacing corporations to the network. Any SWIFT user can administer their entire network connectivity using just one interface;

• Price reduction: In May 2001, SWIFT had announced the pricing challenge in which the goal was to reduce it‘s per message prices by 50% over the 2002–2006 time frame. It is on its way to achieving the pricing challenge. By the end of 2004, it expects to have 26% lower prices in FINonly terms, and 35% lower prices counting InterAct and FileAct usage;

• Open standards support: One of its core responsibilities is to develop, implement and maintain the standards used for messaging on its network. SWIFT is aggressively embracing open standards.

A case in example would be the proposed combination of the financial information exchange (FIX) protocol with SWIFT"s securities message standard, ISO 15022. The new standard, ISO 15022 XML, will incorporate the front-office capabilities of FIX with the traditionally back-office focus of the SWIFT standard, all in an XML format, in order to promote ease of use and flexibility.

• Extending services to Corporates: With the introduction of "Service Participants in a Member Administered Closed User Group" (MACUG) services, non-financial entities can join SWIFT, albeit in a restricted manner. This will enable corporations to communicate with their banks over a reliable and secure network.

• Multiple Telecom vendors for BCP: After 9/11, the importance of business continuity planning has increased manifold. To reduce dependency on a single telecom service provider, improve coverage and increase redundancy, SWIFT has tied up with AT&T, Colt, Equant and Infonet, making them preferred choice for accessing SWIFT network.

While SWIFT is increasingly demonstrating a new found dynamism by initiating aggressive strategies, it has to overcome few major challenges to succeed and find its place under the sun.

• Network latency: An order round-trip from the buy side to the sell side, then to an exchange for execution and back again to the buy side on SWIFT network is expected to take more than couple of seconds. This might not be acceptable, as at the moment, FIX messaging over an IP network is measured in sub-seconds, and buy-side firms will not trade through a network if they cannot execute trades in sub-seconds.

• Delay in SWIFTNet adoption: While the SWIFTNet roll out is as per schedule to achieve the migration by the end of 2004; the response is not as per expectations. SWIFT is introducing host of solutions and services on SWIFTNet e.g. payment standards for bulk payments, payment initiation, and cash reporting. While financial institutions are investing in migration, there is no clarity on their expected rates of adoption of these services.

• Limitations of memberships: SWIFT admitted broker-dealers and asset managers as full members in 2000 and 2001 included corporations as its members. However, there is a strong perception in the industry that securities members have a limited say in the strategy formation and it is primarily driven by banking community. To increase its relevance going forward, SWIFT must innovate and launch new solutions that go beyond the interests of its current ownership.

• Limited support from Asset managers: As per latest statistics, half of the world's 250 largest asset management firms are not yet on the SWIFT network. Only 300 fund managers -- a fraction of the 7,600 financial institutions on the network -- are directly connected to Swift. Its even worse among the thousands more middle- and lower-tier firms which have shown lukewarm interest at best; they still rely on fax, telex and e-mail for transaction messages that could be readily automated via Swift. The primary reasons are their known reluctance to spend money and high cost of hooking up to SWIFT.

Inspite of the all criticism over its lack of agility and innovativeness, SWIFT is banking on its group members and more than 30 years of legacy to become a de facto network for financial services. It would be wishful thinking to expect SWIFT to fade away. Even for financial institutions using their own private networks, SWIFT can play a role in their BCP strategy by providing network redundancy. However, there are credible options emerging for SWIFT which financial institutions should look at and include as part of their network procurement strategy.

• For Banks at present, there is no better choice than SWIFT. With its end to end messaging solutions, new IP based network and decades of experience in serving the banking, SWIFT offers an unbeatable value proposition.

• Securities firms must closely follow SWIFT‘s strategy in the securities space and explore every opportunity to leverage its network and its expertise in electronic message communication.

• Asset managers should explore connecting to SWIFT through more lower-cost connection options available through service bureaus and other "closed user groups" sponsored by members, if they find the cost of hooking up directly very prohibitive.

• For Corporates SWIFT provides a secure, reliable, private TCP/IP network for financial messaging and a single interface to all banks. However, they need to understand the TCO i.e. setup, integration costs and messaging costs. They should evaluate other competing network alternatives such as Slam dunk Networks (especially for companies using costly private networks) and also develop a proper business case before jumping the MACUG bandwagon. While there is a concern regarding participation without representation in the governing body of SWIFT, Corporates should look at SWIFT as a credible option after the movement to TCP/IP network is complete

This might be the end of SWIFT as we know it today. In the next couple of years, by moving to IP based network, SWIFT is aiming to become the first choice messaging network of financial services industry.

While the new players on the block are providing comparable alternatives to SWIFT, we believe, it is still going to be the dominant player in this space. However, going forward we expect to see other vendors getting increased prominence in the network sourcing plans of financial institutions.

The SWIFT Is Dead; Long Live The SWIFT.

Copyright © 2025 Research and Reviews, All Rights Reserved