ISSN: 1204-5357

ISSN: 1204-5357

Abdul Waheed*

Associate Professor, Department of Economics & Finance, College of Business Administration, University of Bahrain, Tel: 00973-35374683; Email: waheedku@yahoo.com.

Visit for more related articles at Journal of Internet Banking and Commerce

This paper analyzes the sustainability of public debt of Bahrain over the period 1990 to 2014. The debt sustainability has been estimated through fiscal reaction function. The ARDL bound testing results confirmed the existence of cointegration between fiscal balance and public debt. The estimation results of the fiscal reaction function also showed that the sufficiency condition for public debt to be sustainable cannot be rejected. The finding confirmed that the fiscal policy measures during the period under study were appropriate in maintaining fiscal solvency and public debt sustainability. The study concludes that the constraints on revenue generation forces the policy makers to relook the economic policy measures to maintain public debt sustainability in future.

Debt Sustainability; ARDL; Cointegration; Error Correction Mechanism

The recent decades witnessed a significant increase in public debt of many countries including the countries that are in the Gulf Cooperation Council (GCC). The rapid growth of public debt has become a constant source of concern for these countries and there is always a question about the debt sustainability for every country. The IMF’s definition of sustainability is: a debt is sustainable if it satisfies the solvency condition without a major correction, given the cost of financing [1]. The debt solvency is achieved when future primary surplus will be large enough to pay back the debt. The unsustainable debt raises serious concern as it may result in debt default. It is important to keep an eye on the sustainability of public debt to avoid future economic crisis.

Bahrain is a very small oil dependent open economy with a population of approximately 1.3 million. Between 2000 to 2014 Bahrain public debt as a ratio of GDP rose from 14.4 percent to 43.76 percent respectively. There is also a significant change in the composition of public debt in the country. The share of external debt in total public debt increased from 15% in 2000 to 45% in 2014. The rise in public debt and change in its composition from domestic to external raises serious questions about its sustainability. There is a growing debate in the country and outside over the sustainability of public debt of Bahrain and its economic implications. The objective of this study is to empirically analyze the sustainability of public debt (domestic and external) of Bahrain for the period 1990 to 2014. The findings of this study will restore the confidence on the economy and set guidelines for the policy makers on this issue. The systematic approach in this study will also be helpful for the analysis of public debt sustainability of other GCC countries in the region.

The paper is structured as follows. Section 2 provides the review of literature pertaining to the assessment of debt sustainability. Section 3 outlines the methodological framework for sustainability analysis. Section 4 performs the analysis and presents the estimation results. Section 5 concludes the study and discusses the policy implications.

The issue related to the sustainability of public debt is widely studied in the theoretical and empirical literature. Debt sustainability generally indicates the country’s ability to service its debt obligations without compromising its long-term development goals. Globally, this issue is more important for future borrowing and debt relief. There are different approaches that provide useful tools to evaluate public debt sustainability.

A first approach is an empirical approach proposed by Bohn [2]. The advantage of this approach is that it provides a straightforward and useful method to conduct an empirical test for debt sustainability based on fiscal solvency. This test requires data on the primary balance, outstanding debt, and a few control variables. The data are then used to estimate a fiscal reaction function, which represents the response of the primary balance to changes in outstanding debt, conditional on control variables. A positive coefficient of the primary balance to outstanding debt confirms the debt sustainability.

The other approach is to study debt sustainability in a dynamic general equilibrium framework with a fully specified fiscal sector to analyze the effects of alternative fiscal strategies to restore debt sustainability. The structure of the model is similar to the Neoclassical models widely studies in the quantitative literature on taxation [3].

Buiter and Patel [4] test the sustainability of public debt of India using the annual time series of data from 1970/71 to 1986/87. The results showed that continuation of same policy will threaten the solvency of the government. They also pointed out that rapid increase in internal public debt signals the forthcoming crisis. They suggested appropriate fiscal measures such as the cut in spending and increase in taxes to least damage the growth prospects of the economy. However, the small sample size and limited degrees of freedom lower the power of their tests.

Silika and Friedrich [5] analyzed the sustainability of public debt on a panel of 15 EU member countries for the period 1970-2004. They applied the test for unit root to the public debt-GDP ratio for the individual countries and found that public debt-GDP ratio is difference stationary for ten EU members countries1. The panel cointegration results showed strong evidence of cointegration between the primary budget and debt-GDP ratio for six EU members countries2. These results confirmed the sustainability of public debt in selected EU countries during the period under study.

Mahmood et al. [6] analyzed the public debt sustainability in case of Pakistan over the decades from the 1970s to 2000s. They adopted traditional debt ratio approach and a theoretical model primarily developed for industrial countries. The analysis of different debt sustainability indicators pointed out that public and external debt of the country has always remained above the critical level. They confirmed that the public debt and external debt of the country remained unsustainable throughout the decades of the 1970s to 1990s. The results of the theoretical model also confirmed that debt of the country remained unsustainable during the period under study.

Deyshappriya [7] conducted the test for sustainability of debt and fiscal balance in Sri Lanka from the period 1950 to 2010. The author employed the intertemporal budget constraint approach and OLS estimation method to determine the factors that affect the net total debt in Sri Lanka. The estimation results showed that GDP, budget deficit, time trend and ethnic problem in Sri Lanka are positively related to public debt. The results confirmed that fiscal policy remained unsustainable during the period under consideration. The author recommended for the expansion in revenue and reduction in expenditure in order to achieve the debt and fiscal sustainability.

Fincke and Greiner [8] using the test proposed by Bohn [2] analyzed the sustainability of public debt for selected European countries over the 30 years period. The estimation results confirmed that the selected countries adapted the fiscal policies that kept their public debt sustainable.

Chandia and Javid [9] performed a detailed empirical analysis of debt sustainability for the economy of Pakistan over the period 1971-2008. They tested debt sustainability by a estimating fiscal reaction function as proposed by Bohn [2]. The estimated results showed a weak positive relationship between surplus-to-GDP ratio and lag debt-to-GDP ratio. The dynamic analysis of the effects of government spending and revenue shocks on debt to GDP ratio were analyzed through a vector autoregressive (VAR) model. The results showed a high response of debt to spending than the revenue. The study confirmed the existence of debt sustainability in Pakistan in its weak form during the period under study.

Ozkaya [10] using quarterly data from 1999Q1 to 2010Q1, analyzed the public debt sustainability in selected OECD countries. The author re-examined three different motives on public debt3 in step-wise econometric test procedure. The results suggested that four OECD countries (Ireland, Greece, Spain, Portugal) have perused unsustainable debt policies over the period under consideration. The empirical findings also confirmed that the other four countries (France, Italy, Poland and Turkey) have pursued sustainable debt policies. The important contribution of the study is the development of a step-wise econometric test procedure to conduct a detailed analysis of long-term debt sustainability.

Benedict et al. [11] analyzed the sustainability and determinants of external debt of Nigeria for the period 1986-2010 using Johansen Cointegration test and error correction mechanism. The results of cointegration test confirmed the existence of a long run relationship between external debt and selected explanatory variables such as GDP, debt servicing and exchange rate. The author concluded that in terms of willingness and ability to pay, Nigeria’s external debt is not sustainable. They urged the government to ensure that the external finance is used only for projects of the highest priority and productivity.

Pradhan [12] assessed the sustainability of public debt in India using cointegration and error correction mechanism. The estimation results showed that public debt in India had been sustainable during the period under study. The author concluded that public debt ratio of India will not come down automatically unless some fiscal corrections are implemented.

The review of existing literature revealed that analysis for debt sustainability requires a thorough analysis of government budget constraint, which includes not only the external debt but also domestic debt. Goldstein [13] pointed out that private sector liabilities should also be included for debt sustainability analysis, because in the case of a financial crisis, these liabilities become part of government debt. The current study considers total public debt to perform sustainability analysis.

This section explains the empirical framework adopted for the analysis of public debt sustainability and identifies the sources of data used in the analysis.

Empirical Framework

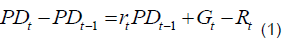

The sustainability analysis for public debt is crucial for a country if there is a large fiscal deficit and rising burden of debt. The public debt sustainability implies that fiscal policies are adopted in a way that inter-temporal budget constraints are satisfied. The budget constraint can be obtained from the following budget identity.

Where PD is the public debt, G is government expenditure and R is the government revenue, r is the interest on public debt. The debt sustainability test proposed by Bohn [2] suggests analyzing whether the primary surplus relative to GDP is a positive function of public debt relative to GDP. The idea behind this test is that the government should follow a fiscal policy that a rising debt ratio should lead to a higher primary surplus relative to GDP. Following equation can be estimated for sustainability of public debt to show that whether the government is a taking suitable measures to confirm intertemporal budget constraint.

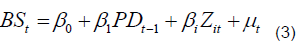

Where BS is the primary budget surplus to GDP ratio and μi is the error term. If β1 turns out to be positive and statistically significant, this provides reliable information about the sustainability of public debt. The theoretical rationale behind this is that the sustainability of public debt cannot be achieved unless the accumulated debt is offset by a large surplus in current period. The primary budget surplus is determined by a set of other variables, which can be included in above equation.

For other determinants (Z) of budget surplus, the current study includes the output (GDP), population (POP), financial deepening (MGDP), inflation (INF) and trade openness (TGDP). The study uses annual time series data of Bahrain over the period 1990 to 2014 to assess the sustainability of public debt. The data for this study is obtained from World Development Indicators and Global Development Finance, published by the World Bank; International Financial Statistics and Regional Economic Outlook: Middle East and Central Asia, published by the International Monetary Fund (IMF); Bahrain Economic Year Book published by the Bahrain Economic Development Board.

Unit Root Test

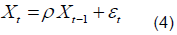

As the current study uses time series data, therefore, it is necessary to test the unit root, to confirm whether the series are stationary or nonstationary4, in order to avoid the spurious regression. The easiest way to introduce the unit root test for stationarity is to consider the following first-order autoregressive model.

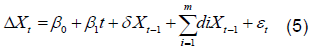

Where εt is the white noise error term, that follows classical assumption of zero mean, constant variance, and non-autocorrelation. If ρ=1, then the stochastic variable Xt has a unit root (random walk), which is an example of a non-stationary time series. Under the null hypothesis ρ=1, the conventionally computed t-statistics is known as “T” (tau) statistic, whose values have been tabulated by Dickey and Fuller [14]. These statistics have been considerably extended by MacKinnon [15] and known as Mackinnon critical values. When Dickey-Fuller test is applied to the following model, it is called Augmented Dicky Fuller (ADF) test.

Where ΔX is the lag difference term and δ=ρ-1, β0 is the intercept and t is the trend. In this case, the null hypothesis is δ=0, that is, there is a unit root. In ADF test lagged difference term on the right hand side are used to correct higher order serial correlation, there is the another test known as Phillips Perron [16] (in short PP test), which makes a correction to the t-statistic from the Autoregressive model (equation 4). Mackinnon critical values can be used in both tests as the asymptotic distribution of ADF and PP test are same5.

The sustainability of public debt can be tested through the test of unit root, following Ozkaya [10] stepwise algorithm procedure as shown in Figure 1. For the test of unit root the ADF and PP tests are used in this study. The use of two different test statistics for assessing unit root in data is simply to deal with anomalies that arise when data do not provide information about the existence of unit root. Two different tests will also ensure that the results are not sensitive to a particular test. The fiscal policy is sustainable if it satisfies the intertemporal budget constraint. Trehan and Walsh [17] defines that difference stationary (that is I (1)) of the public debt is the sufficient condition for the intertemporal budget constraint to be valid. If BS is stationary at level and PD at first difference, then the existence of at least one cointegrating vector between BS and PD will confirm the sustainability of public debt.

ARDL Bound Test

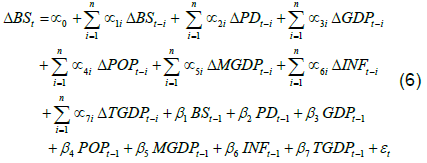

The study uses Pearson et al. [18] Auto Regressive Distributed lag (ARDL) approach to test the cointegration among variables. The ARDL has the advantage over other cointegration methods as it can be used for variables that are integrated of different orders. Furthermore, this method is suitable for small samples. The ARDL representation of equation (3) in extended form is as follows.

Where α0 is the drift component and εt is the usual white noise residuals. The parameters β1 to β7 correspond to the long-run relationship. To investigate the presence of long run relationship among variables the bound testing procedure is used in which the null hypothesis (Ho) of no cointegration is tested against alternative hypothesis (Ha) of the existence of cointegration. This ARDL bound test is based on Wald test (F-statistic), where two critical values are given by Pesaran et al. [18]. The null hypothesis of no cointegration is rejected, if the computed F-statistic is higher than the upper bound critical value. The null hypothesis of no cointegration cannot be rejected, if the F-statistic is less than the lower bound critical value. If the computed F-statistic falls between the two critical bound values, then the results for cointegration are inconclusive.

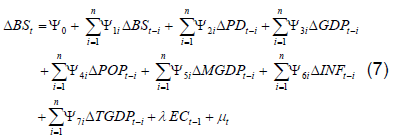

If the long run relationship is confirmed in the above test, then the following error correction model (ECM) is used to estimate the short run coefficients.

Where λ is the speed of adjustment parameter and EC is the residuals, which are obtained from the estimation of the long-run model.

Unit Root Test Results

Table 1 shows the results of the unit root tests performed on both level and first difference with intercept (C) and with intercept and trend (C&T). The results of both models confirmed at level, the acceptance of the null hypothesis of a unit root (with or without trend), for all variables except BS, on the basis of ADF and PP tests. First differencing of all variables yields rejection of null hypothesis of a unit root (with or without trend) at 1% or 5% level of significance, on the basis of ADF and PP tests. Based on these test results, it is, therefore, concluded that all variables are first difference stationary [i.e I (1)] except BS, which is stationary at level [i.e I (0)]. Since the variables of the model are integrated at a different order, the study uses ARDL method to check the existence of cointegratoin among variables.

| Augmented Dickey Fuller test statistics | Phillips-Perron test statistics | |||||||

|---|---|---|---|---|---|---|---|---|

| At level I(0) |

At First Difference I(1) |

At Level I(0) |

At First Difference I(1) |

|||||

| Variable | C | C&T | C | C&T | C | C&T | C | C&T |

| BS | -4.10 | -3.95 | -7.28 | -7.24 | -4.10 | -3.95 | -10.56 | -21.48 |

| PD | -1.18 | -2.56 | -4.58 | -4.48 | -1.15 | -2.67 | -4.99 | -4.85 |

| GDP | 1.85 | -1.05 | -2.96 | -3.82 | 1.96 | -0.70 | -2.90 | -3.84 |

| POP | 0.56 | -1.30 | -3.86 | -3.97 | 0.46 | -1.30 | -3.87 | -3.93 |

| MGDP | -2.56 | -3.02 | -5.28 | -5.23 | -2.61 | -3.12 | -5.82 | -5.85 |

| INF | -3.35 | -3.41 | -7.36 | -7.20 | -3.33 | -3.41 | -7.67 | -7.49 |

| TGDP | -1.86 | -2.03 | -5.31 | -5.19 | -1.86 | -1.98 | -5.31 | -5.19 |

Note: MacKinnon critical values for ADF and PP tests with constant (C) and with constant and trend (C&T) for 1%, 5%, and 10% level of significance are -3.74, -2.99, -2.64, and -4.39, -3.62, -3.24 respectively.

Table 1: Results of Unit Root Test.

Model Estimation Results

Since BS is stationary at level [that is I(0)] and PD is stationary at first difference [that is I(1)], there is a need for at least one cointegrating vector between BS and PD for the public debt to be sustainable as per stepwise algorithm procedure defined by Ozkaya [10] and shown in Figure 1. The ARDL approach is used to test for cointegration among the selected variables. The ARDL technique requires an indication of the lag order. To select the lag order for the VAR model, the information criteria approach is adopted. The lag length selection criteria results are shown in Table 2. All three criteria (AIC, SC, HQ)6 select two lag order for VAR model. Subsequently, the ARDL cointegration test is, therefore, conducted using 2 lags for the VAR model. The value of Wald test F-statistic is 139.13. The critical lower bound value for F-statistic is 5.11 and upper bound value is 6.36 at 1 percent level [18]. The value of Wald F-statistic is higher than the upper bound critical value, which confirms the existence of cointegration among variables of the study. Thus, the existence of cointegration between BS and PD confirms the sustainability of public debt of the country during the period under study.

| Lag Order | AIC | SBC | HQ |

|---|---|---|---|

| 0 | 46.366 | 46.711 | 46.453 |

| 1 | 37.485 | 40.250 | 38.181 |

| 2 | 34.915* | 40.099* | 36.219* |

Note: * indicate lag order selected by the criterion.

Table 2: Lag Length Selection for ARDL Bound Testing.

Table 3 shows the results of long-run model and error correction model estimated through ordinary least square (OLS) method. The general to specific approach is adopted to arrive a good fit model. The coefficient of public debt is positive and highly statistically significant both in the long-run and error correction models. Following Bohn [2], this shows the sustainability of public debt of the country during the period under study. The coefficient of output is negative and statistically significant at 1% level. This indicates that higher output is not causing an increase in tax revenue. This result is not surprising keeping in view the low tax culture in the economy7.

| Long Run Model | Error Correction Model | ||||||

|---|---|---|---|---|---|---|---|

| Variable | Coefficient | t-Stat. | Prob. | Variable | Coefficient | t-Stat. | Prob. |

| Constant | -78.89 | -4.595 | 0.00 | Constant | 0.76 | 0.58 | 0.57 |

| BS(-1) | 0.05 | 0.33 | 0.75 | D(BS(-1)) | 0.05 | 0.50 | 0.63 |

| PD(-2) | 0.40 | 3.01 | 0.01 | D(PD(-2)) | 0.35 | 2.75 | 0.02 |

| GDP | -4.19 | -4.80 | 0.00 | D(GDP) | -4.59 | -3.35 | 0.01 |

| POP | 0.07 | 5.09 | 0.00 | D(POP) | 0.05 | 4.86 | 0.00 |

| MGDP | 0.73 | 4.76 | 0.00 | D(MGDP) | 0.90 | 8.65 | 0.00 |

| INF | 1.20 | 3.48 | 0.00 | D(INF) | 1.46 | 5.71 | 0.00 |

| TGDP | 0.24 | 3.65 | 0.00 | D(TGDP) | 0.32 | 5.78 | 0.00 |

| EC(-1) | -1.02 | -3.86 | 0.00 | ||||

| Adj.-R2 0.73 | F-statistic 9.34 | Adj.-R2 0.89 | F-statistic 22.06 | ||||

| DW Statistic 1.64 | Prob. (F-stat.) 0.00 | DW Statistic 1.81 | Prob. (F-stat.) 0.00 | ||||

Source: Author's estimation.

Table 3: Sustainability of Public Debt of Bahrain.

The effect of inflation on budget surplus may be through various rules, thus making the actual relationship dependent on empirical evidence. In our case the both the long-run and short-run effect of inflation on budget surplus is positive. The financial deepening is also believed to be positively related to fiscal performance. Bayraktar and Wang [19] found that banking openness may increase investment that leads to economic growth. In the case of Bahrain, the financial deepening has also hinted at a positive and highly significant effect on fiscal balance in both the long-run and error correction models.

The effect of population and trade openness is also found to be positive and statistically significant in both models. This suggests that a move towards more open economy is beneficial for the country for a better fiscal stability and debt sustainability.

Diagnostic Tests Results

Table 4 shows the diagnostic test results for the long-run and error correction model. Both models passed different diagnostic tests. The Jarque Bera test results indicate that residuals are normally distributed. The Breusch-Godfrey serial correlation LM test confirmed that there is no problem of serial correlation in both models. ARCH-LM test and White Heteroskedasticity tests results indicate that there is no problem of heteroskedasticity and residuals are homoskedastic. The forecasting ability of the long-run model is good as indicated by the bias proportion and variance proportion.

| Test | Test Statistic | Long Run Model | Error Correction Model | ||

|---|---|---|---|---|---|

| Test Value | Probability | Test Value | Probability | ||

| Jarque-Bera statistic | χ2-statistic | 0.300 | 0.861 | 0.496 | 0.780 |

| Breusch-Godfrey Serial Correlation LM Test |

F-statistic χ2-statistic |

0.093 0.326 |

0.911 0.849 |

0.871 3.008 |

0.446 0.222 |

| ARCH LM Test | F-statistic χ2-statistic |

1.647 1.674 |

0.214 0.196 |

0.037 0.041 |

0.849 0.839 |

| White Heteroskedasticity test | F-statistic χ2-statistic |

1.276 15.887 |

0.375 0.320 |

0.756 15.563 |

0.696 0.484 |

| Forecast Ability of Model | Bias Proportion Variance Proportion |

0.000 0.049 |

--- --- |

0.335 0.059 |

--- --- |

Source: Author’s estimation.

Table 4: Diagnostic Test Results.

Figures 2 and 3 shows the CUSUM and CUSUM of squares plot for the long-run model and error correction model respectively. The figures show that CUSUM and CUSUM of square plots for both models where the residuals movement are within the critical line. This is the indication about the stability of parameters in both long-run and error correction model.

There is always a question of sustainability of public debt for both developed and developing countries. A sustainable debt is one that satisfies the intertemporal government budget constraint. In this paper, the fiscal reaction function approach is used to study the debt sustainability. According to this approach a positive, conditional response of the primary balance to debt is sufficient to establish debt sustainability. Currently the public debt situation of GCC countries is not satisfactory and there are questions on the sustainability of debt of these countries. It is therefore important to check the sustainability of public debt of these countries. This study considered the case of Bahrain and tested the sustainability of public debt of the country over the period 1990-2014. An important contribution of this study is the use more rigorous time series econometric techniques for the assessment of the debt sustainability and identification of specific policy measures that can maintain the sustainability of public debt.

The study first checked the unit root and found that fiscal balance is level stationary and public debt is first difference stationary. Since the two series were stationary at different levels, the study used the ARDL cointegration techniques to find the existence of cointegration in the series. The ARDL bound testing results confirmed the existence of cointegration between fiscal balance and public debt, which is evidence of public debt sustainability of country during the period under study. To further support this result, the study calibrated the fiscal reaction function on the time series data of Bahrain over the period 1990 to 2014. The estimation results show that sufficiency condition for public debt to be sustainable for Bahrain cannot be rejected. The finding confirms that the fiscal policy measures during the period under study were appropriate in maintaining fiscal solvency and debt sustainability. However, the recent fall in oil prices and constraints on revenue generation particularly through taxes, force the policy makers to relook the economic policy measures to maintain public debt sustainability. Trade openness and financial deepening are two important areas that can maintain fiscal solvency, which requires special attention of the policy makers in the country.

The policy makers also need to keep an eye on the movement of surplus to GDP ratio and debt to GDP ratio. If the debt to GDP ratio is increasing and surplus to GDP ratio in falling, the government needs to react with appropriate fiscal policy measures to increase the surplus to GDP ratio, in order to maintain the public debt sustainability.

The GCC countries have strong economic and cultural relationship. An important extension of this study would be to check the public debt sustainability of other countries in the region. This will help policy makers to design a collective strategy for the public debt sustainability.

This paper is the outcome of the research project entitled “Sustainability and Determinant of External Debt: Empirical Analysis for Bahrain” funded by the Deanship of Scientific Research, University of Bahrain, Kingdom of Bahrain.

1 These countries were Austria, Finland, France, Germany, Greece, Ireland, the Netherlands, Portugal, Sweden, and the UK.

2 These countries were France, Germany, Luxembourg, Portugal, Sweden, and the UK.

3 The three different motives for repayment are: ‘Illiquidity”; “unwillingness to pay” and “insolvency”.

4 A variable whose moments (mainly mean and variance) are time invariant is said to be stationary.

5 Both ADF and PP tests are sensitive to number of lags used in the test. For lag length selection the commonly used methods are Akaike Information Criterion and Schwarz Information Criterion.

6 AIC is the Akaike information criterion, SC is the Schwarz information criterion and HQ is Hannan-Quinn information criterion.

7 Bahrain is a country with no income tax and very low other taxes. The main source of government revenue is the export of oil.

Copyright © 2025 Research and Reviews, All Rights Reserved