ISSN: 1204-5357

ISSN: 1204-5357

Regional University of Blumenau, PPGCC/FURB Câmpus 1 Central R. Antônio da Veiga, 140 - Sala D-202. Itoupava Seca, Blumenau – SC – Brazil

Linda Jéssica De Montreuil CarmonaUniversidade Regional de Blumenau, Brazil

Jurema TomelimUniversidade Regional de Blumenau, Brazil

Henrique Corrêa Da CunhaUniversidade Regional de Blumenau, Brazil

Gérson TontiniUniversidade Regional de Blumenau, Brazil

Visit for more related articles at Journal of Internet Banking and Commerce

This study verifies the nonlinearity of main inductors of customer satisfaction with the quality of online banking services. To that end, we performed an exploratory and quantitative research, through a survey applied to a sample of 256 respondents, e-banking service users. Using an exploratory factorial analysis, we identified eight input dimensions, composed of 33 relevant attributes, listed as inducers of the quality of e-banking services. Then, we used a non-linear regression technique (Penalty Reward Contrast Analysis) to classify dimensions related to the quality of the e-banking services as “basic”, “one-dimensional”, “attractive” or “neutral”, and compared the outcomes of this method to a linear regression analysis. The results point out that, controlled by gender and education, the dimensions “support to transactions” and “safety” are one-dimensional attributes; the dimensions of “convenience,” “decision support,” and “problem solving” are basic attributes, and “design” and “benefits” can be considered as attractive or exciting attributes. In addition, the results show that the nonlinear analysis explains 12.5% better the variance (Adj. R2) of general customer evaluation of the service, than traditional linear analysis. The contribution of this study consists in clarifying the service quality factors affecting customer use of Internet banking services, valuable to improve quality services.

Service Quality; E-Banking; Penalty and Reward Contrast Analysis; Kano Model; Nonlinearity

The banking industry occupies a crucial position in the global economy, receiving billions of dollars of investments each year for technological infrastructure related to e-banking [1]. It has being subject to internal and external influences, accentuated since the 1980’s, due to technological, political, economic and social changes that had repercussion in the creation of new laws, empowering customer rights [2].

High staffing costs have encouraged many service providers to develop innovations to enable self-services, a fact facilitated by technology development, especially by the use of the Internet [2-5]. These innovations provide new ways of doing business and a greater interaction among companies and customers, enabling the fulfillment of web-based self-services, at anytime and anywhere, with potential to achieve high levels of customer satisfaction [1,6,7].

Because of the highly profitable profile of the online banking industry (Internet Banking or e-banking), a fierce competition among banks is being experienced [8]. Thus, this industry is becoming increasingly intensive in the provision of online self-service products, considering its competitive differentiation possibilities [2,9].

Data published in 2016 by the Brazilian Federation of Banks, registering the performance of the 17 major Brazilian banks (that represent 93% of industry’s assets in Brazil) state that almost half of the financial operations carried out in Brazil are made through channels of mobile and e-banking, which together account for 54 percent of the total banking transactions. According to this study, in the year of 2015, sixty two million customers (out of a total of 155 million) were already using e-banking services, which represented a growth of 27% in this channel’s transactions, just in 2015 [10].

The growth in the number of e-banking services users explains why over the past two decades banking portals have been developed, offering a wide variety of web-based services, allowing customers to use various online resources [11]. A wide range of online financial services allows customers to perform a variety of transactions on a single website, such as paying bills, reviewing bank statements and making investments [8]. Nevertheless, due to the competition, measuring service quality is a critical factor for both, consumers and suppliers [3,12-14], being key to the identification of customer satisfaction determinants [15].

Berry et al. [16] indicate that consumers demand high quality services, while suppliers expect that the increase in service quality improve their image, as well as lead to greater profitability. Nevertheless, the use of self-service technologies can also bring inhibitory effects in consumption, if customers are dissatisfied or unprepared to use [17]. According to Matzler and Sauerwein [15], early studies on customer satisfaction began in the 1970s, focusing only in two dimensions: satisfaction and dissatisfaction. New research broadened this analysis to include a new dimension: attractiveness, which increases customer satisfaction, but does not cause dissatisfaction, if absent or having low performance.

Models of measuring service quality applied to assess traditional services based on the interaction between people, such as customers and employees of companies, may not be applicable to virtual environments because of the technological mediation. As a result, many aspects considered in quality models to capture the interaction of interpersonal services, may be irrelevant in the transactional process between customers and online information systems [18].

Previous studies about Internet banking services include the adoption of e-banking technologies [7,19,20], measuring service quality [1,2], motivators to e-banking services use [5,14,21], customer satisfaction with internet banking [8,22-25]; age segmentation on e-banking use [26]. However, to our knowledge, no studies have specifically investigated and classified the dimensions and attributes as nonlinear inductors of customer satisfaction in the e-banking service industry, what can be useful to deploy strategies of service quality management.

Based on these arguments, this research intends to complement the studies of Bauer et al. [1] and Jun and Cai [11], responding the following questions: What are the key dimensions and attributes that induce customer satisfaction with the e-banking services quality? Is there a nonlinear impact on customer satisfaction?

Thus, the objective of this study is twofold: first, empirically verify the main dimensions and attributes that induce customer satisfaction with the quality of e-banking services and then, classify them based on a nonlinear perspective, in order to identify which attributes can be improved or maintained.

The main contribution of this study is the use of the Penalty and Reward Contrast Analysis (PRCA) methodology, as a proposal to classify customer satisfaction dimensions and attributes of e-banking. Among a variety of possible methodologies, PRCA has the advantage of being able to measure asymmetric relationships between levels of attribute satisfaction versus general satisfaction, providing a superior diagnostic value against other techniques [15].

This study is structured in four sections in addition to the introduction. The following section presents a literature review on the topics related to quality in banking services and dimensions of service quality on e-banking portals. Then, methodological procedures are described, followed by a discussion of results. Finally, concluding remarks are presented.

This topic presents a theoretical review on the quality in banking services and dimensions of service quality on e-banking portals.

Quality in Online Banking Services

According to Loonam and O'loughlin [4], the banking and financial services have unique characteristics in terms of complexity, specificity and high level of risk, involving purchasing decisions. In recent years, the banking services have experienced a significant transformation, changing from an interpersonal orientation of relative intensity to interactions of high technology.

Changes in banking legislation in recent decades have led banks to start marketing non-traditional products, such as corporate stocks and securities, allowing the exploration of businesses outside their main line, realizing that e-banking allows delegating tasks to the customers, saving time and resources as well as reducing errors [2]. At a basic level, Internet banking, or e-banking, consists of providing a banking portal with information about products and services, involving the delivery of resources to customers for accessing to accounts, transfers and purchase of financial products [8,27].

The use of e-banking is focused on cost savings, in contrast to the physical channels, attracting customers to new products and retaining existing customers [2]. Besides this, the use of online banking services distribution channels increases market coverage, targeting several demographic segments to meet specific needs and preferences [9].

Research has found that in offline environments service quality is crucial to the satisfaction and customer loyalty [1]. This assertion is also true in online environments, becoming a major motivator for lowering prices and for pioneering in the provision of products or services in the market [1]. Over time, the quality of information has become important in achieving quality levels that guarantee positive results for banks, differentiation of services, and customer satisfaction and loyalty [9].

Studies related to the quality of online banking services focus on various aspects in the assessment of quality. One of the first studies to investigate the quality of online banking service of type B2C (Business to Consumer) was Gounaris an Dimitriadis [28] work (2003), which identified three dimensions of quality using the SERVQUAL model (customer care, risk reduction, information and facilitating interaction). However, this model was criticized because the dimensions presented only 14 attributes that did not cover many relevant aspects of the business activities of e-banking portals [1].

In turn, Jayawardhena [29] adapted SERVQUAL scale to the online context, through a set of 21 items that encompassed five dimensions of service quality: access, website interface, trust, attention and credibility. Although the study explains, by factorial analysis, 59% of the variance, several authors also criticize it, because it ignores hedonic aspects of online service consumption, represented by fun/pleasure [3].

Other international studies focusing on the banking industry also addressed similar dimensions, as showed in Table 1:

Table 1: Similar studies on e-banking dimensions.

| Authors | Sample | Instrument | Method | Results / Dimensions |

|---|---|---|---|---|

| Tan et al. [7] | 300 respondents Singapore | Online Questionnaire | Factorial Analysis | Behavioral control factors play a significant role in the use of internet banking. |

| Bauer et al. [1] | 280 respondents Germany | Online Questionnaire | Factorial Analysis | Verification of the quality of banking portal services, analyzing the dimensions of safety, trust, service quality, added value, transaction support and responsiveness. |

| Lichtenstein and Williamson [21] | 32 respondents Australia |

Interview | Qualitative Survey | Convenience is the main motivator of e-banking services |

| Poon [5] | 324 respondents Malaysia |

Online Questionnaire | Variance Analysis | Satisfaction Sources: accessibility, convenience, design and content. Acceptance sources of e-banking services: privacy, safety and convenience. |

| Qureshi [14] | 235respondents Pakistan | Interview | Regression and Correlation | Reasons to use the online system: utility, safety and privacy. |

| Chong et al. [20] | 103 respondents Vietnam | Interview | Regression and Correlation | Positive association with the intention to use e-banking: utility, trust and government. |

| Ahmad et al. [23] | 179 respondents Jordan |

Questionnaire | Regression | Positive effect on satisfaction: accessibility, convenience, safety, content privacy and design. |

| Pahuja and Virk [24] | 300 respondents India | Questionnair | Factorial Analysis | Proposition of nine dimensions: access, potential, integration, modernity, convenience, diversity, easiness, multi-installation and efficient management. |

| Xavier [25] | 204 respondents Brazil |

Online Questionnaire | Correlation and Factorial Analysis | Tested dimensions: efficiency, easiness, organization and satisfaction. Emphasis for efficiency dimension. |

Based on the knowledge of the main determinants of consumer satisfaction with online services quality, it is possible to indicate a starting point for the establishment of effective management of e-business quality. In the following section, the main dimensions of quality in online banking portals are described.

Dimensions of Service Quality on E-Banking Portals

Several studies have sought to identify the factors that influence customer satisfaction with quality of services [23,25]. Parasuraman et al. [12] identified ten dimensions that determine the quality of services: tangibility, credibility, reliability, responsiveness, communication, access, competence, courtesy, safety and understanding of needs.

Later Parasuraman et al. [13] proposed the SERVQUAL Model, reformulating the quality dimensions, which include: tangibility (physical attributes, equipment and presentation), reliability (ability to perform the agreed between the company and the customer), responsiveness (provision to help customers), friendliness/ trust (courtesy and confidence in the services offered) and empathy (individualized attention to meet the specificities and needs of each client). Therefrom, for the retail banking arena, [30] refined the criteria relating them to value perception and diversity of services, including: effectiveness/safety, accessibility, price, tangibility, portfolio of services and reliability.

Following is a synthesis of the literature on e-banking service quality, including some of the main dimensions considered in customer satisfaction studies of e-banking services used in this research:

The "Website Design" dimension includes the contents of the website, and is the dimension that exerts direct influence on user satisfaction, providing the quantity and content of the product information, through the format, language and layout that influence a relevant perception, information accuracy and completeness [2,23]. According to Poon [5], the goal of design is to make the website visually attractive and fun.

"Problem solving ability" or "responsiveness" refers to the rapid and timely service capability of the service to respond promptly to customer requirements and/or complaining, either by the system or by the queue [30]. Loonam and O'loughlin [4] indicate that, responsiveness helps in building the relationship with consumers, because it fosters the understanding of customer needs.

"Safety" or “security” is a crucial dimension when conducting financial transactions online, because it aims at the protection of personal and financial information of consumers, while preserving their privacy and confidentiality [2,11,30]. Bank services websites have encryption technology, provided through a combination of unique identifiers, protocols, and algorithms used to minimize the risk of fraud [5,31].

"Technical Support" and "Decision Support" reflect the skills, competence and professionalism of the online service attendants, including mechanisms for supplying services according to clients' needs [32,33].

"Website Convenience" relates to the ability of customers to access the Internet at any time and place [5,11,21]. According to Ahmad and Al-Zu’bi [23], easiness of access is perceived as an advantage that results in an attractive factor of the online banking platform.

"Benefits with additional services" refer to new services available in e-banking, associated with the innovation capacity of the bank adapting to technology and technical support [5]. The range of products that constitute the product/service portfolio makes this dimension one of the most important in choosing a bank [11].

"Flexibility" represents the ability of service providers to enhance or change the nature of the product or service to meet the needs of customers [30]. Flexibility interrelates with greater frequency of use in intermediate and advanced users, due to a perception of greater control over financial options [4].

"Satisfaction with service quality" indicates that the migration of users to online banking can result in significant savings of operating costs [5]. For the author, less interpersonal interaction with customers may create communication problems between the institution and the users, affecting the general evaluation of the bank. Dimensions of customer satisfaction with the e-banking sector highlight the quality of the service, through human interaction with the communication channel, that can lead to identification of the main points to be investigated [5]. Offering high quality services to meet the needs of consumers, at lower costs, constitutes a long-term competitive advantage of online banking [34-36].

This topic presents the methodological steps used to carry out the proposed study.

Penalty and Reward Contrast Analysis (PRCA)

The PRCA method, based in Kano [37], emphasizes the classification of attributes as a function of its influence on the level of general satisfaction with a product or service, implying that, what is important for the company is to maximize the overall performance to exceed consumer expectations [34,35].

PRCA has the assumption of existence of nonlinear and asymmetric relationships between the performance of attributes of products/services and the overall customer satisfaction, employing a type of dichotomized regression with dummy variables [35]. The analysis is based on β coefficients, with the regression equation: Y=β 0 + β 1 X 1 pos + β2 X2 neg + ...+ β n x n pos + β n x n neg), where Y is the general satisfaction and "X n" is the satisfaction with each attribute (or dimension), in case of multi-attributes [36].

When the satisfaction of the attribute is above a certain reference value, the reward variable (Xlpos) is greater than zero and the penalty variable (Xlneg) is equal to zero. If the satisfaction of the attribute is below the reference, the penalty variable (Xlneg) is below than zero and Xlpos is equal to zero. When the performance is equal to the reference, Xlpos and Xlneg are equal to zero. Thus, two regression coefficients are obtained for a single independent variable: 1) When the satisfaction with the attribute is lower and; 2) When the satisfaction is greater than the reference value [37-40].

PRCA allows knowing which attributes of the provided service should be improved and which should be maintained [41]. These attributes can be classified into basic, one-dimensional, attractive or neutral, according to the magnitude of the penalty and reward coefficients [15].

Basic attributes, present the penalty coefficient with magnitude much higher than the reward coefficient; one-dimensional attributes present the penalty coefficient with magnitude close to the reward coefficient; attractive or exciting attributes present the reward coefficient with magnitude much higher than the penalty coefficient; and, finally, neutral attributes do not influence the overall satisfaction, regardless of performance [39].

Research Type, Population, Sample Size and Profile

This research is descriptive and causal about the objectives; as to procedures, it is defined as a survey using a questionnaire, and the approach is defined as quantitative, cross-sectional study. The population is composed of users of e-banking services residents of several locations in Brazil, with varied profiles, of both genres and of various ages.

The final sample consisted initially of 280 respondents. After some exclusion, due to the fact that they indicated a high level of incompleteness or because they presented a mean variance close to zero in most of the answers, it resulted in a final sample of 256 respondents, clients of several online banks in Brazil that had expressed possible problems and resolutions related to e-banking services.

Regarding the profile of the respondents, this indicates a slight male majority (52%), with complete higher education (79%), formal employment (85%), and majority of age between 26 to 35 years old (50%), as shown in Table 2.

Table 2: Respondents Profile.

| Respondents Profile | Gender | Frequency | Percentage |

|---|---|---|---|

| Gender | Male Female |

134 122 |

52% 48% |

| Age | 0 ~ 25 26 ~ 35 36 ~45 46 ~ 65 |

43 125 55 26 |

17% 50% 23% 10% |

| Education | Primary High School Undergraduate Graduate |

3 6 46 201 |

1% 2% 18% 79% |

| Professional Profile | Formal work Informal work Looking for a job Unemployed |

217 21 8 10 |

85% 8% 3% 4% |

Table 3 shows that the respondents use a diverse range of banks for their operations, especially Bank of Brazil (27%), followed by Itau (19%), Bradesco (16%), Caixa Econômica Federal (11%), as well as cooperative banks (10%). The vast majority of respondents use e-banking services from two to five years (53%), six to nine years (19%) and over ten years (16%) for personal purposes and work, especially for payments and investments, sometimes during the month (77%) or once a week (20%).

Table 3: Use of e-banking services.

| Data | Alternatives | Frequency | Percentage |

|---|---|---|---|

| Bank used in e-banking operations | Bank of Brazil Bradesco Caixa Econômica Federal HSBC Itaú Santander Sicoob/Viacred Credit Unions Others |

71 41 28 20 48 17 26 5 |

27% 16% 11% 8% 19% 7% 10% 2% |

| Experience (years) | Above 10 6-9 2-5 Below 1 |

41 48 135 32 |

16% 19% 53% 12% |

| Frequency of online transactions | Many times a day Several times a week Once a week A few times a month |

2 6 51 197 |

1% 2% 20% 77% |

Data Collection and Research Variables

The data collection was conducted by means of electronic questionnaire, via a link to a form developed by e-Survey Creator, sent by email in the period between 01 and 15/Dec/2015. As a way to validate the model proposed in this study, we carried out a pre-test by applying a questionnaire, via e-mail, to a group of 32 users of e-banking services, chosen by convenience.

The statements were built by means of a Likert scale of 7 points, ranging between 1 "Totally Disagree" and 7 "Totally Agree". The dimensions and indicators of the model were guided according to the demonstrated literature review, which gave rise to a questionnaire consisting of 62 questions. Eight dimensions were considered, containing 35 indicators, and 1 dimension of output represented by 4 indicators, as well as the control variables of gender, age, education level and frequency of online transactions, as shown in Table 4, followed by the used abbreviations, definitions and authors.

Table 4: Research Construct.

| Type | Dimension | Variables | Indicators | Authors |

|---|---|---|---|---|

| Input | Decision Support | Sup_dec1 | Suggestions to help in decision making; | Pahuja and Virk [24], Xavier et al. [25], Tax and Brown [32] |

| Sup_dec2 | Advisory services on bank products; | |||

| Sup_dec3 | Comparative information tools; | |||

| Sup_dec4 | Management Tool for personal savings. | |||

| Support for online transactions | Sup_trans1 | Account manager support; | Bitner et al. [6], Tax and Brown [32], Zeithaml et al. [33] | |

| Sup_trans2 | Technical support of the bank; | |||

| Sup_trans3 | FAQ - Frequently asked questions; | |||

| Sup_trans4 | Online chat service instructions; | |||

| Sup_trans5 | Online Help Menu | |||

| Online operations Safety | Secur_1 | Safety in operations; | Bauer et al. [1], Jayawardhena and Foley [2], Poon [5], Qureshi [14], Johnston [30], Bahia and Nantel [31], Zeithaml et al. [33] | |

| Secur_2 | Safety in the virtual environment (password, safety card, virtual keyboard); | |||

| Secur_3 | Privacy of information; | |||

| Secur_4 | Online operations conference messages. | |||

| Website Design | Lay_1 | Site Layout | Jayawardhena and Foley [2], Poon [5], Ahmad and Al-Zu’bi [23], Xavier et al. [25] | |

| Lay_2 | Site visual and colors | |||

| Lay_3 | Graphic elements, website animations | |||

| Lay_4 | “Links" presentation on the site. | |||

| Benefits with additional services | Benef_1 | Loyalty program; | Poon [5], Jun and Cai [11], Chong et al. [20] | |

| Benef_2 | Benefits by banking movement | |||

| Benef_3 | Transfer of points to other services and products (purchases, mileage programs, etc.). | |||

| Site Convenience | Conv_1 | Variety of online transactions | Poon [5], Qureshi [14], Chong et al. [20], Lichtenstein, S, Williamson [21], Pahuja and Virk [24], Xavier et al. [25], Oppewal and Oppewal Vriens [40] | |

| Conv_2 | Easiness to make online operations; | |||

| Conv_3 | Speed to make online operations. | |||

| Flexibility of services | Flex15 | Flexibility and availability of schedules; | Loonam and O'loughlin [4], Johnston [30] | |

| Flex15 | Attendance to specific needs (hearing, visual, etc.); | |||

| Flex 3 | Possibility of customization; | |||

| Flex_4 | Flexibility for opening accounts at the site; | |||

| Flex_5 | Variety of possible transactions; | |||

| Flex_6 | Mobile access and transactions; | |||

| Flex_7 | Flexibility to access by different computers. | |||

| Satisfaction with the resolution of problems | Sat_sol1 | Satisfaction with resolution of problems; | Loonam and O'loughlin [4], Johnston [30] | |

| Sat_sol2 | Satisfaction with the bank contact about the problem (s); | |||

| Sat_sol3 | Return on the solution of the problem(s); | |||

| Sat_sol4 | Compensation for losses related to the problem(s); | |||

| Sat_sol5 | Aid for the resolution of the problem(s). | |||

| Dependent Variable (output) | Quality of online services | Qual_1 | Satisfaction with the services provided by online bank; | Bauer et al. [1], Poon [5], Ahmad and Al-Zu’bi [23], Xavier et al. [25] |

| Qual_2 | The online service of this bank is of high quality. | |||

| Qual_3 | The online service of my bank meets what is expected. | |||

| Qual_4 | The e-banking service meets the needs. | |||

| Control Variables | Gender | Gen. | Gender (male/female) | Poon [5], Qureshi [14], Chong et al. [20], Lichtenstein and Williamson [21], Ahmad and Al-Zu’bi [23], Pahuja and Virk [24], Xavier et al. [25] |

| Age | Age | Age | ||

| Education | Education | Education (high school, complete or incomplete higher education). | ||

| Frequency of Online Transactions | Freq. | Frequency of use of online banking |

Data Analysis

For data analysis, we carried out an Exploratory Factor Analysis (EFA), Varimax rotation and ANOVA variance analysis. EFA procedures provide accurate results a researcher wishes to identify a set of latent constructs underlying a battery of measured variables [42].

The Varimax method seeks to maximize the variation between the weights, where each original variable tends to be associated with one or a small number of factors that represent only a small number of variables [43]. In addition, ANOVA is used to evaluate the statistical differences between the means of two or more groups. Traditionally, ANOVA is the statistical analysis approach employed to test research hypotheses [44]. Next, linear regression analysis, and Penalty and Reward Contrast Analysis (PRCA) are used to verify the non-linear antecedents of consumer satisfaction on e-banking portals.

Confirmation of Researched Dimensions

The initial analysis showed 8 components or dimensions, and 33 indicators with explanatory capacity of 77.5% of the accumulated variance. It should be noted that, in the case under analysis, the resulting loads were all positive [43], as shown in Table 5:

Table 5: Rotated Components Matrixa.

| Variable | Indicators | Component | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Satisfaction with the Resolution of problems |

Website Design | Safety of online operations | Transaction online Support |

Decision Support | Convenience of the site |

Additional Service Benefits | Flexibility of services | ||

| Sat_Sol2 | Satisfaction with the bank contact on the problem(s) | 0.923 | |||||||

| Sat_Sol3 | Return as the solution to the problem(s) | 0.888 | |||||||

| Sat_Sol5 | Aid for the resolution of the problem(s) | 0.871 | |||||||

| Sat_Sol1 | Satisfaction with the resolution of the problem(s) | 0.857 | |||||||

| Sat_Sol4 | Compensation for losses | 0.767 | |||||||

| Lay_2 | Colors and visual of the site | 0.834 | |||||||

| Lay_3 | Graphics and Animations | 0.830 | |||||||

| Lay_4 | Presentation form of links on the site | 0.815 | |||||||

| Lay_1 | Site layout | 0.810 | |||||||

| Secur_2 | Safety in the virtual environment | 0.897 | |||||||

| Secur_1 | Safety in operations | 0.864 | |||||||

| Secur_3 | Privacy of information | 0.862 | |||||||

| Secur_4 | SMS Messages | 0.599 | |||||||

| Sup_trans2 | Bank technical sector support | 0.778 | |||||||

| Sup_trans3 | FAQ - Answers to frequently asked questions | 0.750 | |||||||

| Sup_trans4 | Online chat service | 0.720 | |||||||

| Sup_trans5 | Online Help Menu | 0.682 | |||||||

| Sup_trans1 | Manager's support in online operations | 0.675 | |||||||

| Sup_dec3 | Tools of comparative information; | 0.828 | |||||||

| Sup_dec2 | Consultancy Services of offered products | 0.819 | |||||||

| Sup_dec1 | Suggestions to assist in decision making; | 0.799 | |||||||

| Sup_dec4 | Tool for personal economic managing | 0.781 | |||||||

| Conv_3 | Speed of online transactions | 0.719 | |||||||

| Conv_1 | Variety of online transactions | 0.671 | |||||||

| Conv_2 | Easy of online transactions | 0.656 | |||||||

| Flex_6 | Possibility of cellular transactions | 0.632 | |||||||

| Benef_3 | Possibility transfer points | 0.868 | |||||||

| Benef_1 | Program of loyalty points | 0.858 | |||||||

| Benef_2 | Benefits offered by moving | 0.798 | |||||||

| Flex _3 | Possibility of customization; | 0.793 | |||||||

| Flex_2 | Meet needs (hearing, visual, etc.) | 0.663 | |||||||

| Flex_4 | Flexibility in opening accounts | 0.639 | |||||||

| Flex_1 | Flexibility of schedules for transactions | 0.508 | |||||||

| Accumulated Variance | 12.19 | 23.63 | 34.37 | 44.93 | 55.10 | 63.04 | 70.78 | 77.50 | |

| Cronbach's Alpha coefficient | 0.93 | 0.96 | 0.90 | 0.88 | 0.92 | 0.87 | 0.90 | 0.75 | |

Extraction Method: Main component analysis (MCA). Method of rotation: Varimax with Standardization

According to Table 5, the eight evaluated input components showed significant values of Cronbach's Alpha, ranging between the “flexibility of services” (0.75), the “convenience of the site” and “technical support” (0.87 and 0.88), “benefits with additional services” and “safety in online operations” (0.90 each), “decision support” and “resolution of problems” (0.92 and 0.93) and, finally, “website design” (0.96). Alpha de Crohnbach is an unbiased estimator of the correlation between the responses of a questionnaire, calculated from the variance of the evaluated items, where the minimum acceptable value is 0.70, because, below this value, the internal consistency of the scale is considered low [45].

The rotated output dimension referring to quality presented a relevant Alpha (0.96), showing a factorial charge that explains the model [29]. Factorial values greater than 0.5 indicate an adequate correlation between factors [46].

Table 6 presents the linear regression analysis, having as dependent variable the quality dimension, and as control variables: Gender, Age, Education and Frequency of online transactions. As we can see, the variance analysis ANOVA confirmed the significance of the model with a significance of 0.000 (<0.005).

Table 6: Coefficients of Linear Regression.

| Model | Non-standardized coefficients | Standardized Coefficients | T | Sig. | |

|---|---|---|---|---|---|

| B | Standard Error | Beta | |||

| (Constant) | 0.301 | 0.420 | 0.717 | 0.474 | |

| Support for Online Transactions | 0.296 | 0.048 | 0.310 | 6.123 | 0.000 |

| Convenience | 0.272 | 0.048 | 0.287 | 5.704 | 0.000 |

| Website Design | 0.269 | 0.048 | 0.282 | 5.608 | 0.000 |

| Safety | 0.249 | 0.048 | 0.258 | 5.129 | 0.000 |

| Decision Support | 0.138 | 0.048 | 0.146 | 2.858 | 0.005 |

| Benefits with additional services | 0.100 | 0.048 | 0.105 | 2.086 | 0.038 |

| Gender | 0.236 | 0.098 | 0.123 | 2.412 | 0.017 |

| Education | -0.240 | 0.102 | -0.123 | -2.368 | 0.019 |

| Frequency of bank online transactions | 0.072 | 0.040 | 0.092 | 1.774 | 0.077 |

Stepwise regression, p-value <0.1; ANOVA F=16,928 Sig 0=0,000

Residuals (normal): Asymmetry=-0.076 Standard Error=0.152

Kurtosis=0.079 Standard Error of Kurtosis=0.303

R2=0.382 R2Adj=0.360

Dependent variable: quality

According to Table 6, it can be seen that results proved to be statistically significant [46] in six of the eight dimensions analyzed: support for online transactions, convenience, design, safety, decision support and additional services benefits (Sig. <0.05). The dimensions: flexibility and resolution of problems did not reach statistical significance and therefore are not present in the Table 6.

The variables of gender control and education reached statistical significance (sig. p-value<0.05), while the frequency of online transactions and age were not representative. The explanation of the model can be observed, among other forms, through the determination coefficient R2, which shows the adequacy in 38.20% (R2=0.382) and in 36% (Adj. R2=0,360).

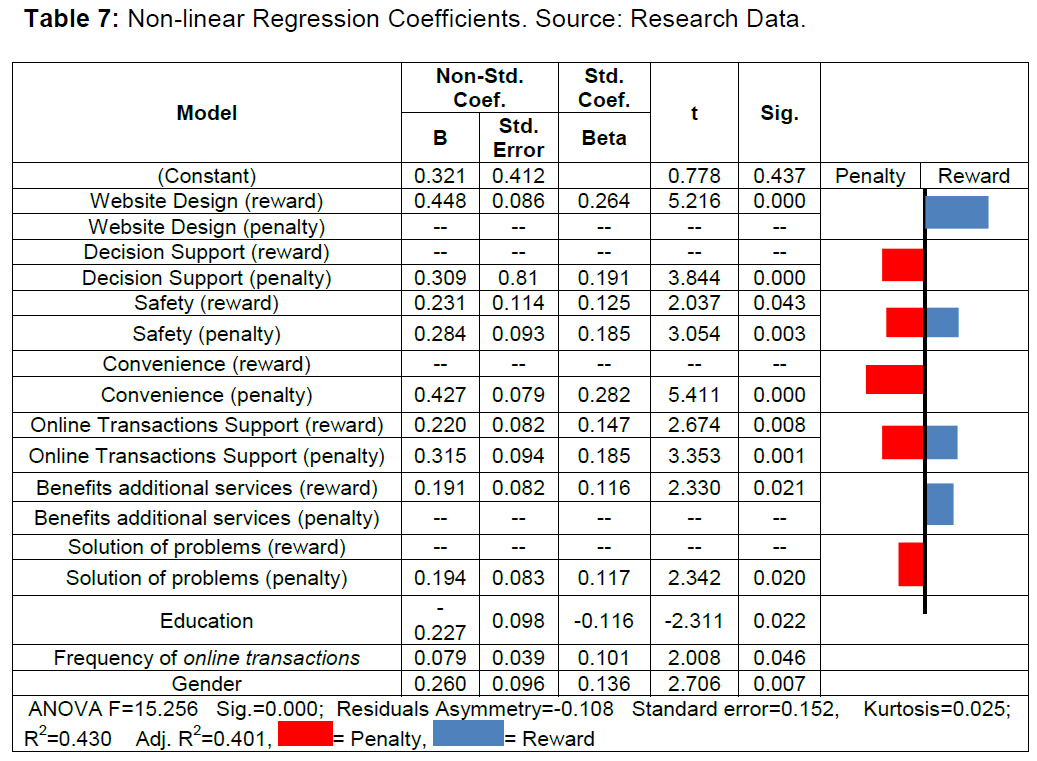

Table 7 shows the results obtained by the PRCA method, also having as a dependent variable the "Quality" dimension and control variables the gender, education and frequency of online transactions.

Table 7 shows, by means of the absolute values for the standardized regression coefficients, the degree of contribution of each dimension to the perception of quality of online banking services [1,12,28]. The significance of relations was appropriate in dimensions (Sig. <0.05), and when observed the results of the statistical test "T" values [46]. As we can see, the dimensions “transaction support” [6,32] and “safety” [1,5,12,14,23,31] showed similar values in both the reward as the penalty, which allows to classify them as one-dimensional attributes.

In turn, the dimensions “website design” [2,5,23] and “benefits with additional services” [1] presented indicators related only to the reward, being classified as attractive attributes. They increase satisfaction if present or having high performance, but they do not cause dissatisfaction if absent or with low performance [15,39].

The “convenience” [5,21,23,24], “support to decision” [1] and “satisfaction with resolution of problems” [6,32] indicated only penalties, being classified as basic or must-be attributes. This type of dimensions exert an influence on the satisfaction if being below the average of the market and represent penalties, that must be overcome to meet consumer expectations [15,34,35]. Based on these results, Table 8 shows strategy for online banking services.

Table 8: Online banking strategies per dimension.

| Type | Dimensions | Online banking strategy |

|---|---|---|

| One-dimensional | Transaction Support; Safety | Prioritize the attributes of these dimensions in the current improvement strategies. |

| Attractive | Benefits with additional services; Website Design | In order to improve customer satisfaction, e-banking strategies should focus in these attributes to outperform current average of customer satisfaction. |

| Basic (Must-be) | Convenience; Support to decision; Resolution of problems | It is critical to keep these attributes/dimensions at least, in the market average level for not losing customers. |

It should be noted that in the comparison between the linear method (Table 6) and the non-linear one through PRCA (Table 7), it shows that the adequacy of the regression model (R2) is higher in the nonlinear model (0.430) than in the linear one (0.382). The linear model verified the significance in six input dimensions (support for online transactions, convenience, website design, safety, decision support and benefits with additional services), influenced by the control variables: gender, level of education and frequency of transactions. Nonlinear model obtained by PRCA allowed the identification of seven dimensions, one more than the linear model (satisfaction with the solution of problems), and these seven dimensions were influenced by control variables. The “flexibility” dimension did not reach significance in the results of neither linear nor non-linear analysis.

This exploratory research aimed at verifying the dimensions and attributes inductors of customer satisfaction with the e-banking services. To this end, it was used a sample of 256 respondents users of these banking services.

Aligned with the proposed objective, it can be concluded that, influenced by gender and education, the “support to transactions” and “safety” can be considered one-dimensional factors, which impact on the perception of e-banking service quality, either if having either high or low performance. The dimensions “convenience”, “decision support” and “satisfaction with the resolution of problems” may be considered as basic dimensions, that is to say that cause dissatisfaction if absent, but they do not lead to satisfaction when present or having performance above current market average. “Website design” and “benefits with additional services” dimensions can be considered attractive or exciting attributes, which increase satisfaction when present, not causing dissatisfaction when absent [15,39].

The results obtained allow showing the degree of contribution of each dimension to the perception of the quality of online banking services. This method (PRCA) has been used successfully to identify and classify satisfaction factors in a variety of situations, with the advantage of being able to measure asymmetric or non-linear relationships between satisfaction levels of attributes/ dimensions versus general satisfaction [15,39].

Among the limitations of the study, there is the impossibility of generalization of the results, considering that the sampling was non-probabilistic and by convenience, and that the investigation took a short time period for data collection. As a possibility of future research, it is indicated the application of the questionnaires addressed in this work in other samples for validation of the proposed model, focusing on specific demographic and instructional profiles of the respondents [14]. It could also be expanded the study to samples of non-users of online banking, whose answers could enrich the research in this area [5].

Copyright © 2025 Research and Reviews, All Rights Reserved