ISSN: 1204-5357

ISSN: 1204-5357

Hanudin Amin

Lecturer and Head of Islamic Finance Program, Universiti Malaysia Sabah-Labuan International Campus

Postal Address: Labuan School of International Business and Finance, Universiti Malaysia Sabah-Labuan International Campus, Jalan Sungai Pagar, 87008 Labuan Federal Territory, Malaysia

www.ums.edu.my

Email: hanudin_zu@yahoo.com

Hanudin has written several articles in Journal of Internet Banking and Commerce (JIBC). Indeed, this has pursued him to explore more area in Internet Banking and Commerce, to be published in JIBC. His areas of interest are Islamic banking products and e-banking.

Visit for more related articles at Journal of Internet Banking and Commerce

The aim of this paper is to study technology acceptance of internet banking among undergraduate students in Malaysia. Thus, the theoretical framework of the paper is based on modified version of Technology Acceptance Model (TAM). This paper develops a technology acceptance model for internet banking, a conceptual framework to explain the factors influencing undergraduate students' acceptance of internet banking. The model employs perceived usefulness (PU), perceived ease of use (PEOU), perceived credibility (PC) and computer self-efficacy (CSE). The first two are two initial constructs for TAM model. The rest are new constructs to be included in the model in order to have an extension of TAM model that better reflects the students’ view. The results suggest that PU, PEOU and PC had a significant relationship with behavioral intention. Further, these measures are good determinant for undergraduate acceptance for internet banking. Results also suggest that PU and PEOU had a significant relationship with CSE. On the contrary, CSE did not associate with PC. Also, PEOU had a significant relationship with PU and PC that indicate these scales are related to PEOU in explaining undergraduate preference. The paper is useful in providing the understanding of the TAM among undergraduate from Malaysians’ perspective.

Banking; Technology acceptance model; Students; Malaysia

It is an accepted fact that Internet banking is become a central field of study by many researchers in Malaysia. Specifically, the recent study conducted in Internet banking is done by Guriting and Ndubisi (2006) who studied Borneo online banking. Among the other Malaysian internet banking researches are Ndubisi and Sinti (2006), Ndubisi et al. (2004), Suganthi and Balachandran (2001) and Shanmugam and Guru (2002), to mention a few. These studies uniquely offer a specific understanding on Internet banking acceptance among Malaysians. However, it is limited for them to explore the undergraduate’ behavioral intention over internet banking acceptance. Previous studies were silent to address specifically undergraduate as their main target of research (i.e. Karem, 2003; Ndubisi et al., 2004; and Sathye, 1999). Thus, the current study is designed in order to study undergraduate acceptance of Internet banking.

Although internet banking provides flexibility in performing financial transaction, fast and easy, however Malaysians are still reluctant to adopt the system because of several reasons. First, the security and privacy are two elements in the perceived credibility. Without a proper knowledge of the system, individuals are not interested to test the system. Indeed, Tan and Teo (2000) found risk to be a very significant factor and Ndubisi et al. (2004) also agreed the importance of adequacy of security in order to raise the confidence of public to utilize the system. Second, internet banking is mixed-blessing. It consists of the software and hardware costs such as needing internet-connection, personal computer or laptop and maintenance in order to ensure its can be implemented. Third, internet banking is seen as an alternative, is still limited to apply to the Malaysians at large due to computer literacy. Therefore, in order to promote the use of Internet banking, some situations need to be met. First, it is important to create “confidence” among individuals about the system by providing a sufficient information and “useful” for their critical thought before use the system range from “know-how” to security. Second is that perhaps in the future, banks provide e-banking centers to promote the use of the system and provide sufficient assistant in case of the customers got stuck. Third, banks must support the use of the system by providing in-group training in order to make them aware and believe about the usefulness of the system. As we know Internet banking was permitted in June 2001 by Bank Negara Malaysia (BNM) to local banks and in January 2002 to foreign banks. A continuous observation is carried by BNM in order to protect customer away from any losses caused by Internet banking.

The objective of the paper is to explain the factors influencing undergraduate students' acceptance of internet banking in Malaysia. Thus, the theoretical framework of the paper is based on modified version of Technology Acceptance Model (TAM). TAM is chosen because of two main reasons (Guriting and Ndubisi, 2006). First, because TAM helps to better understand the relationship between the five important constructs of the study, namely PU, PEOU, PC, CSE and BI. Second, TAM more than any other model is acclaimed for its parsimony and predictive power which make it easy to apply in different situation (Ndubisi and Jantan, 2003; Venkatesh and Morris, 2000). Most fundamentally, perceived ease of use and perceived usefulness are addressed as the most important constructs in predicting information system acceptance (Cheong and Park, 2005 and Guriting and Ndubisi, 2006). In addition to that, the researcher proposed perceived credibility and computer self-efficacy in order to enhance our understanding of undergraduate acceptance of Internet banking beyond the general constructs of TAM (i.e. perceived ease of use and perceived usefulness).

The paper is organized as follows. Section one deals with literature review and hypotheses that relevant to the present study. Third section attempts to discuss the model of the study. Section fourth attempts to justify the methodology of study. Fifth are to analyze the data findings. Finally, the author attempts to highlight a number of conclusions, implications of the study, limitations and potential future study relevant to the present study topic.

The previous studies have illustrated the importance of TAM. TAM has received better empirical support in information technology research by many research studies regardless the country concerned (i.e. Guriting and Nelson, 2006; Wang et al., 2003; Ramayah and Ling, 2002; and Venkatesh and Morris, 2000). A further modification of TAM is necessary since TAM was created for a general explanation of the determinants of computer acceptance rather than for the specific topic of behavioral intentions of Internet banking adoption as planned to further discussed in the present study. In this part, the author highlights the original constructs of TAM namely PU and PEOU, followed by PC and computer self-efficacy. The following further discussed about the studies touch on the mentioned constructs:

Perceived usefulness

According to Davis (1989) perceived usefulness is defined here as the degree to which a person believes that using a particular system would enhance his or her job performance. In many instances, there is also extensive research in the Information System (IS) community that provides evidence of the significant effect of perceived usefulness on usage intention (i.e. Guriting and Nelson, 2006; Venkatesh and Morris, 2000; and Venkatesh and Davis, 1996 to name a few).

The proposed relationship between perceived usefulness and behavioral intention is based on the theoretical argument by Wang et al. (2003), and Guriting and Nelson (2006). Wang et al. (2003) found that perceived usefulness has a positive effect on behavioral intention to use the Internet banking. In simple words, perceived usefulness has a significant relation on behavioral intention. Guriting and Nelson (2006) found that perceived usefulness and perceived ease of use significantly determine behavioral intention. These studies offer an insight for the author to further investigate the following hypothesis:

H1: Perceived usefulness will have a positive effect on behavioral intention to use the Internet banking systems.

Perceived ease of use

According to Davis (1989) perceived ease of use refers to the degree to which a person believes that using a particular system would be free of effort. Extensive research over the past decade provides evidence of the significant effect of perceived ease of use on usage intention, either directly or indirectly through its effect on perceived usefulness (Venkatesh, 2000; Venkatesh and Morris, 2000; Agarwal and Prasad, 1999; Davis et al., 1989). By extending these study results, the author proposes the following hypotheses for Internet banking adoption among young Malaysians in Labuan:

H2: Perceived ease of use will have a positive effect on perceived usefulness of the Internet banking systems;

H3: Perceived ease of use will have a positive effect on perceived credibility of the Internet banking systems; and

H4: Perceived ease of use will have a positive effect on behavioral intention to use the Internet banking systems.

Perceived credibility

According to Wang et al. (2003) perceived credibility consists of two important elements namely privacy and security. Further, security refers to the protection of information or systems from unsanctioned intrusions or outflows. Fear of the lack of security is one of the factors that has been identified in most studies as affecting the growth and development of e-commerce (Wang et al., 2003) including for Internet banking adoption.

According to Wang et al. (2003), found that perceived credibility had a significant positive effect on behavioral intention. Moreover, Ramayah and Ling (2002) found that Internet banking users are very concerned about security and majority of them are using Internet banking for accounts enquiry only due to the credibility concern. These study results are supported by Sathye (1999) who found that Australian consumers are not adopting Internet banking because they are concerned about safety and security of transactions over the Internet. Indeed, Suganthi et al. (2001), Daniel (1999), O’ Connel (1996) discovered that security concern in an important affecting acceptance and adoption of new technology or innovation. Based on these studies results, the author pleases to propose the following hypothesis in order to further observe the relationship between perceived credibility and behavioral intention but, from the Malaysians’ point of view:

H5: Perceived credibility will have a positive effect on behavioral intention to use the Internet banking systems.

Computer self-efficacy

According to Compeau and Higgins (1995) computer self-efficacy is defined as the judgment of one’s ability to use computer. Previous studies have shown that there is empirical evidence on the effect of computer self-efficacy on perceived usefulness and perceived ease of use that has been documented (i.e. Agarwal et al., 2000; Venkatesh, 2000; Venkatesh and Davis, 1996; Igbaria and Livari, 1995).

The proposed relationship between computer self-efficacy and perceived ease of use is based on the theoretical argument by Davis (1989), Wang et al. (2003) and Guriting and Nelson (2006). There also exists empirical evidence of a causal link between computer self-efficacy and perceived ease of use (i.e. Venkatesh and Davis, 1996; Igbaria and Livari, 1995; Venkatesh, 2000; Agarwal et al., 2000).

The proposed relationship between computer self-efficacy and perceived credibility is based on the theoretical argument by Guriting and Ndubisi (2006) and Wang et al. (2003). Guriting and Ndubisi (2006) in their study found that computer self-efficacy is significantly associated with perceived usefulness and perceived ease of use. Further, Wang et al. (2003) implying that computer self-efficacy will have a negative effect on perceived credibility of the Internet banking.

Indeed, Wang et al. (2003) in their study found all three hypotheses concerning the effects of computer self-efficacy on perceived usefulness, perceived ease of use, and perceived credibility were supported. Furthermore, computer self-efficacy had a positive effect on both perceived usefulness and perceived ease of use, and had a negative effect on perceived credibility. These studies are provided a framework for constructing the following hypotheses in order to establish a new insight about Internet banking adoption among young Malaysians specifically in Labuan.

H6: Computer self-efficacy will have a positive effect on perceived usefulness of the Internet banking systems;

H7: Computer self-efficacy will have a positive effect on perceived ease of use of the Internet banking systems; and

H8: Computer self-efficacy will have a negative effect on perceived credibility of the Internet banking systems.

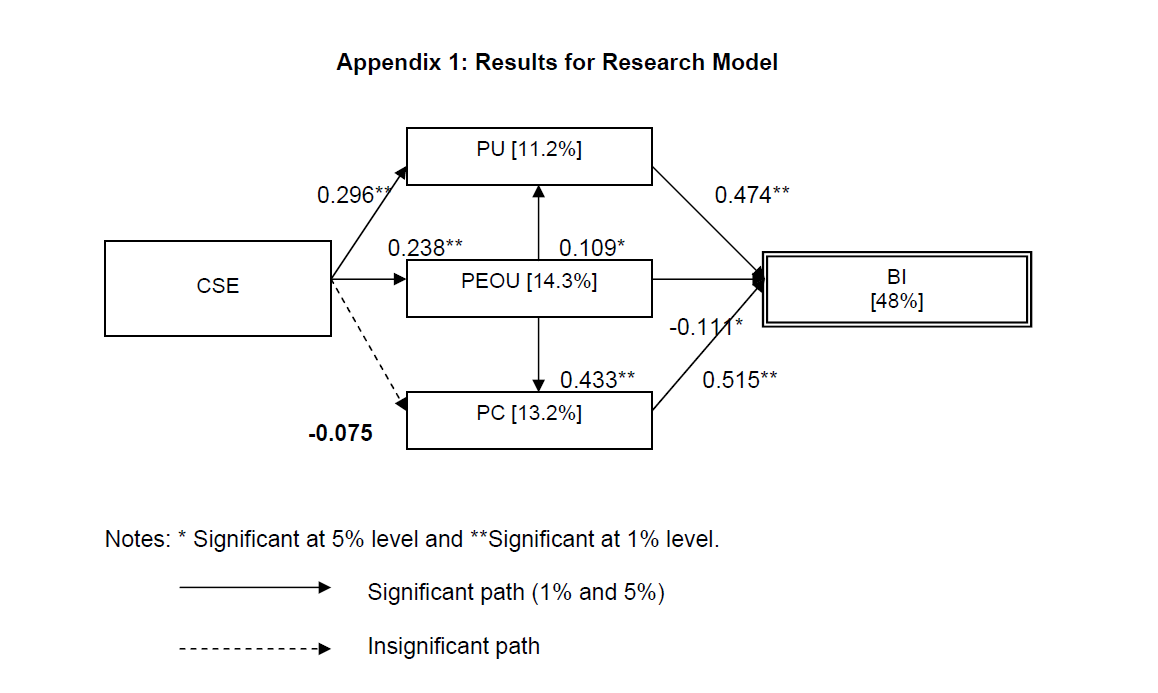

The model of the study is presented below. The model was adapted from the previous study Guriting and Nelson (2006), Pikkarainen et al. (2004), Wang et al. (2003), Venkatesh (2000) and Davis (1989). The model is applied to study the sample of Malaysians that may helpful to explain the Malaysians’ acceptance on Internet banking in Malaysia banking environment. The model is appeared below:

Sample

With respect to the sampling, a convenience sampling was utilized to survey about 250 students at the Labuan School of International Business and Finance. The reasons of using this sampling type are twofold. First, it offers an easy way to obtain the raw data for the further analysis. Second, it saves times and costs since the respondents can be randomly selected. The potential respondents were those who are never using Internet banking. In short, those students who were used Internet banking was exempted to participate in the survey. The study is conducted in one of the public universities operate in Malaysia, namely Universiti Malaysia Sabah – Labuan International Campus (UMS-LIC). In the university campus, there are two schools open for the public, namely Labuan School of International Business and Finance (SPKAL) and Labuan School of Informatic Science (SSIL). The former is related to the business and finance study. The latter is for those students who are master in information system (IS). The study is conducted during the first semester of 2006/07 where the study was conducted in the SPKAL, some of the SSIL students were participated. SSIL students were registered for the minor course of business and finance courses in order to complete their syllabus. Choosing this campus is because of two reasons. First, those business and economics student are revealed with the knowledge of applied business and economics. At the same time, they are equipped with the knowledge of computer science, where the concept of Internet banking is not an alien for these students. Second, it was found that there is no study ever conducted in the campus, it leaves a motivation to the research to perform a study in order to investigate the students’ adoption for Internet banking in the near future. The data is directly collected by the author via self-administered method. Needless to say, the study conducted in the period from 1 March to 1 April 2006. Sample demographics are displayed in Table 1.

The profile of respondents is shown in Table 1. The ratio of male respondents to female respondents is slightly almost equal, given the 42.4% of the male respondents and 57.6% are female respondents. Majority of the respondents are aged 20-29 years old because they are undergraduate students where the age number is common for those so-called university’s students. By religion, most of the respondents are Muslim with 77.6% while the rest will be non-Muslim. In terms of school, most of the respondents are from SPKAL with 92.8% and SSIL with 7.2% because the study sample is largely devoted to the business and finance students. By race, Bumiputra (i.e. Bajau, Melanau, Kadazandusun, Murut, Suluk, and Malay, to name a few) is equal to 77.6% followed by Chinese (15.2%) and Indian (6.4%).

Measures

The data for the study was collected via a questionnaire. The questionnaire was constructed in two sections. First section attempts to verify the profile of the respondents. Second section attempts to measure the agreement by respondents over their acceptance of Internet banking. The measures are five measures are constructed range from perceived usefulness to computer self-efficacy. These measures are tested in order to observe their affect toward behavioral intention to use. In the questionnaire, all concepts are measured based on or using seven-point scales ranging from “strongly disagree” (1) to “strongly agree” (5).

The questionnaire items were adapted from different sources. Perceived usefulness with three items were adapted from Wang et al. (2003). Perceived ease of use with four items was adapted from Nysveen et al. (2005). Perceived credibility with two items were adapted from Pikkarainen et al. (2004). Behavioral intention with two items was adapted from Venkatesh (2000). Finally, computer self-efficacy with three items was adapted from Wang et al. (2003). Prior to the distribution of the questionnaire, the questionnaire received improvement by pre-tested its by using 4 mature lecturers mastering in banking and marketing research based in Labuan, Universiti Malaysia Sabah.

Further, the research instrument was tested for reliability using Cronbach’s coefficient alpha estimate. The Cronbach’s alpha values for all dimensions range from 0.70 to 0.82, exceeding the minimum alpha of 0.6 (Hair et al., 1998), thus the constructs measures are deemed reliable.

Moreover, factors analysis is also conducted. The aim of factors analysis is to confirm the construct validity of the scales could be performed adequately by using principle component analysis (PCA). In order to reach this, the minimum factor loading of 0.6 on its hypothesized constructs is proposed (Nunnally, 1978). A number of analyses were conducted for factors analysis. Factor loading values were obtained using varimax rotation. According to the above table, most of the factor loading for each instrument exceeded 0.6, meeting the essentially significant level of convergent validity.

The results of the multiple regression analysis indicate that PU, PEOU and PC are significantly associated with behavioral intention. Further, H1 is confirmed with the study results which show that perceived usefulness has a positive relationship with behavioral intention (t=12.01, p-value=0.000). The result is consistent with the previous studies (i.e. Guriting and Nelson, 2006; Wang et al., 2003; Venkatesh and Morris, 2000; and Venkatesh and Davis, 1996) who claimed that perceived usefulness has a significant relationship with behavioral intention to use information system (IS).

H2 is confirmed. It indicates that perceived ease of use has a significant effect on perceived usefulness (t=2.033, p-value=0.043). Further, H3 is also supported which means perceived ease of use has a positive effect of perceived credibility (t=16.112, p-value=0.000).

Moreover, H4 is significant at the 5% level, the result shows a negative relationship between perceived ease of use and behavioral intention (t= -2.360, p-value=0.05). This is supporting the hypothesis indirectly. The result is supported by the previous studies such as Venkatesh (2000) and Venkatesh and Morris (2000).

The results also show that H5 is confirmed. Indeed, the result shows that perceived credibility has a positive effect on behavioral intention to use the internet banking system (t=6.591, p-value=0.000). Therefore the result is consistent with previous studies such as Ramayah and Ling (2002) and Sathye (1999) who claimed that perceived credibility was a determinant of behavioral intention.

Furthermore, H6 is confirmed. In other words, computer self-efficacy has a positive effect on perceived usefulness of the Internet banking systems (t=5.049, p-value=0.000). The result is supported by the previous study ever conducted in Malaysia, which is referred to Guriting and Ndubisi (2006) who found that computer self-efficacy is significantly associated with perceived usefulness.

H7 is also confirmed. We can conclude that computer self-efficacy has a positive effect on perceived ease of use of the Internet banking systems (t=3.366, p-value=0.001) also consistent with Guriting and Ndubisi (2006) and Wang et al. (2003) studies results.

On the contrary, H8 is not supported by the current result. Computer self efficacy has no significant relationship with perceived credibility of the Internet banking systems (t=1.722, p-value=0.086). Hence it is concluded that computer self efficacy is not a determinant of perceived credibility. In fact, the result is inconsistent with the study result of Wang et al. (2003).

This paper has provided an impression about the determinants that influence university students’ intention to use Internet banking in the future. By extending TAM, the author has developed an extension of the TAM model which is incorporating additional constructs such as computer self efficacy and perceived usefulness. Furthermore, this study reflects the Internet banking understanding from the undergraduate point of view. They are selected because of their potency to become an active banking customers in the future, where all the services offered by banks are tend to be tested by them. Additionally, the study highlights key findings which are read as follows:

• Perceived usefulness – Internet banking should be treated as important. The banks investment are not stop at the initial costs of setting the system, further it complements by having further education to make the system attractive to customer.

• Perceived ease of use – Internet banking should be treated free from effort. Further justification is needed to ensure the system beneficial to customers at large.

• Perceived credibility – it is a ‘heart of the system’. Without a proper security and privacy, perhaps Internet banking is looked as a menace to the customers instead of banking channel alternative. Therefore, further enhancement in the quality of security and privacy should observe over time to reduce losses for customers.

• Computer self-efficacy – doing internet banking is not easy as doing internet surfing. Internet banking deals with the customers’ money which is always be a priority. Thus, indoor training and sufficient guidelines are needed to make sure the customers are pleased and fulfilled their rights as customers.

Further, the study suffers from two setbacks. First, the sample is devoted to the undergraduate population situated in the small Island of Labuan. The view of the undergraduate may differ from those who are staying in the big cities such as Kuala Lumpur, Shah Alam, and Pulau Pinang. Thus, the results may be limited to the specific location, and hard to predict its usefulness to other Malaysians in other cities. Second, the measures perhaps are not sufficient to predict the determinants why undergraduate use the system. Therefore some of the new measures may be included in the future.

In order to tackle these limitations, therefore the author proposes two-solutions. The first setback can be minimized by extending the future studies to other universities sample such as International Islamic University Malaysia (IIUM), Universiti Malaysia (UM), Universiti Sains Malaysia (USM) and Universiti Kebangsaan Malaysia (UKM). Therefore by conducting study in these universities, we can compare the results and look the gap in order to further investigate the undergraduate adoption for Internet banking. Second setback may be diminished by including other measures such as prior computing experience, personal innovativeness, normative pressures and training for internet banking use. Therefore, by using these measures, more interesting finding will be raised in order to increase the knowledge base of TAM in the Malaysians’ point of view.

Copyright © 2025 Research and Reviews, All Rights Reserved