ISSN: 1204-5357

ISSN: 1204-5357

Ksenia Valeryevna Ekimova*

Plekhanov Russian University of Economics, 36 Stremyanny per., Moscow, 117997, Russian Federation

Aleksei Ilyich Bolvachev

Plekhanov Russian University of Economics, 36 Stremyanny per., Moscow, 117997, Russian Federation

Zograb Mnatsakanovich Dokhoyan

Plekhanov Russian University of Economics, 36 Stremyanny per., Moscow, 117997, Russian Federation

Tamara Petrovna Danko

Plekhanov Russian University of Economics, 36 Stremyanny per., Moscow, 117997, Russian Federation

Elena Viktorovna Zarova

Plekhanov Russian University of Economics, 36 Stremyanny per., Moscow, 117997, Russian Federation

Olga Leonidovna Shemetkova

Plekhanov Russian University of Economics, 36 Stremyanny per., Moscow, 117997, Russian Federation

Vladimir Dmitriyevich Sekerin

Moscow State University of Mechanical Engineering, 38 Bolshaya Semenovskaya St., Moscow, 107023, Russian Federation

Visit for more related articles at Journal of Internet Banking and Commerce

In the conditions of the negatively changing economic situation due to geopolitical processes, the problem is becoming urgent of choosing new ways of development in order to preserve financial stability and to increase the value of companies. It is known that diversification is one of the most popular strategies to achieve long-term financial goals of a company. A properly developed strategy, reasonable allocation of resources ensure stability of the company's cash flows during ups and downs in different sectors of economy, make it possible to act more flexibly in the market. In this connection, the problem of choosing the right diversification strategy aimed at maximizing the value of the company is becoming particularly important. This requires answering the following types of questions: how to determine reasonably the degree of diversification of the business? What is the optimal degree of diversification of the company? What impact does it have on the value of the company? It is no secret that one of the main factors that determine the investment attractiveness of the company is its value. Therefore, the account of various factors in the assessment of the company's value is important. The accuracy of reflection of its real value depends on the quality of this assessment.

Development Strategy; Diversification; Valuation; Value of the Company; Financial Stability

Historically, in determining the degree of diversification, companies use two approaches: the quantitative and strategic ones. The quantitative approach makes it possible to objectively estimate the number of areas in which the company operates on the basis of public corporate reporting of the company [1]. In the strategic approach, the degree of subjectivity is large [2].

In the West, the degree of diversification of a company is estimated by the number of industries in which the company operates. Accordingly, the larger the number of industries in which the company conducts its business, the more diversified it is [3].

Also, such approaches are widely used as Berry’s relative index, entropy index and others [4].

The analysis of the above approaches has shown that their application is limited by the availability of data for individual sectors in which companies operate, which is especially characteristic of the companies in the developing countries and, in particular, Russia [5]. In connection with this, it is proposed to use the following model for estimating the degree of the company’s sectoral diversification on the basis of the Herfindahl-Hirschman index:

(1),

(1),

where D is the degree of company’s diversification;

N is the total number of the companies of the group;

Ni is the number of companies of the group, functioning in the i-th sector;

M is the number of sectors in accordance with the codes of the Russian-wide classifier of economic activity.

The model can assume the following limit values:

1. D → 1 – the companies of the group are distributed over a large number of sectors, the group's activities are fully diversified.

2. D=0 – all companies of the group operate in the same industry, the group is non-diversified.

Therefore, the closer the value of D to 0, the more concentrated is the group with respect to branches, whereas the closer D to 1, the stronger the group is distributed over the branches.

Ranking of companies according to the values of D allows distinguishing the following groups:

• D1: [0; 0.25) – non-diversified and poorly diversified companies;

• D2: [0.25: 0.5) – companies with an average degree of diversification;

• D3: [0.5; 0.75) – companies with a high degree of diversification;

• D4: [0.75; 1) – highly diversified companies.

As the advantages of this model we may indicate:

• It is easy to use. The use of existing methods for assessing the degree of diversification of the Russian companies is a challenging problem, sometimes an impossible one due to the objective and subjective reasons, such as: non-transparency of financial statements, the absence or unavailability of information on the company, which is in the basis of calculations. The proposed model is based entirely on the data from the company, which are reflected in the annual financial statements and are freely available.

• The magnitude of D is affected not only by the number of subsidiary companies of an individual multisectoral company, but also by the fact how they are distributed over the codes of Russian National Classifier of Economic Activities (RNCEA); thus, it is affected by the combination of these two factors.

• The possibility of further development of the model adjusted for individual types of activity.

Thus, taking into account the fact that the proposed model for evaluating the degree of diversification of Russian companies is based on publicly available information, it can be widely applied in practice for taking strategic and administrative decisions by the management of companies, as well as in the further scientific research.

The results of studies by various authors and in different times do not give a clear answer to the question whether diversification of the business of a company increases or decreases its value. Some of these studies suggest that diversification usually reduces the company's value [6]. The results of other studies reveal a direct relationship between the diversification of the company and the increase of its value [7].

Research by Lang and Stulz [8], Berger and Ofek [9] and others have shown that diversified companies are quoted at a significant discount in comparison with the narrow-profile companies operating in the same industries.

In their empirical studies Lamont [10], Shin and Stulz [11], Rajan et al. [12], Stein and Scharfstein [13] show that diversified companies either manifest inefficiency in the allocation of their own funds, or suffer from bad allocation of capital because of agency problems. Despite the assumption that the manager, as an agent of the shareholders or directors, should make decisions that are aimed at maximizing company value and shareholder wealth, he/she is more interested in the increase of his/her bonuses. Very often such motivation leads to misallocation of capital.

Rajan et al. demonstrate that the greater the diversification of investment opportunities with respect to segments, the greater is the non-rational use of internal capital and the discount for diversification. This means that, on average, with an increase in the degree of diversification, companies are beginning to invest insufficiently in the divisions with higher possibilities of development and over-invest in those where the opportunities of development and expansion are lower [14]. The authors come to the conclusion that all these internal processes ultimately lead to a decrease in the value of diversified companies [15].

Thus, it can be seen that the above studies reveal a discount for diversification; i.e. a decrease of the company's value is expected due to its diversification [16]. As the most important reasons of decreasing the value of companies, there can be identified the inefficient use of the domestic capital market, i.e. misallocation of resources between segments of the diversified company and the agency problems [17].

Santalo and Becerra [18] come to the conclusion that the effects of diversification are heterogeneous and depend on the sectoral specificity of the company. That is, the diversified companies operating in certain sectors can have a lower value, while the implementation of activities in other sectors may increase the company's value. They point out that the effectiveness of diversified companies is greater in the branches of economy with less narrow-profile companies, that is, where their total market share is small. Conversely, the results of activities of diversified companies are lower in those sectors where there is a high concentration of the share of narrow-profile competitors.

Villanalonga and Kuppiswamy [19] argue that, during the 2007-2009 financial crisis, the relative value of diversified companies has increased significantly. These research findings show that financial constraints and capital market conditions, apparently, continue to play a key role in determining the value of diversified companies, and that over time there should be a dynamic change in the discount and premium for diversification. According to the authors, to assess the impact of diversification on the company’s value, it is very important, in the first place, to determine correctly the degree of diversification of the company.

The analysis of theoretical and practical studies by different authors has showed that, despite a significant amount of research on the impact of diversification on the company's value, there is no consensus about the diversification effect and its relation to the value of the company [20]. In today's reality, this issue is particularly relevant for Russian companies. In this regard, there arises an objective need for studying the impact of diversification on the value of companies and determining an optimum degree of diversification of companies, taking into account the Russian specifics.

To conduct the study, a sample is composed of thirty Russian companies, taken from the "Expert-400" rating (rating of the largest Russian companies by the sales volume). The source of information is the consolidated financial statements of the companies and their subsidiaries, prepared in accordance with International Financial Reporting Standards (IFRS).

Based on the authors' model of determining the degree of diversification of the Russian companies and the analysis of financial-economic indicators (profitability, liquidity, financial stability) of their activity, it is necessary to build a model of assessing the impact of diversification on the value of companies together with their financial-economic indicators.

To construct such a model, the correlation-regression analysis is used. As a performance indicator (y) of the model, there acts the ratio of the market value of the company to its assets, whereas as the factorial indicators (x1, x2,…xn) there are used the degree of diversification of the companies and their financial-economic indicators.

Out of thirteen financial indicators of the company activity, three indicators are selected on the basis of correlation analysis, and they are included in the regression model.

• the diversification degree of the company (D);

• return on assets for gross profit (ROAGP);

• return on sales for operating profit (ROSOP);

At the bottom of establishing such a relationship, there is the use of multivariate correlation-regression analysis. In particular, on the basis of the observed values of all characteristics for thirty companies, there arises a task to describe the relationship between them in the form of a multiple correlation model, which has the following general form:

![]() (2)

(2)

The economic-mathematical model (2) allows determining the impact on the effective rate (the value-to-assets ratio) of each of the factors separately (degree of diversification, return on assets by gross profit, operating profit margin of sales), as well as their aggregate impact on it.

Taking into account the linear relationship between the performance and factorial characteristics, the equation of multiple linear regression has the following form:

![]() (3)

(3)

Where:

1.885 is the regression coefficient, showing how the performance indicator (the ratio of the company’s value to the assets) changes when the degree of diversification changes by 1%;

1.102 is the regression coefficient, showing how the performance indicator (the ratio of the company’s value to the assets) changes when the return on assets for gross profit changes by 1%;

2.097 is the regression coefficient, showing how the performance indicator (the ratio of the company’s value to the assets) changes when the operating profit margin of sales changes by 1%;

–0.948 is a coefficient that shows the average value of the value-to-assets ratio when the factors are equal to 0. This is a free term of the equation, showing the degree of influence of the unaccounted factors.

The information that gives grounds to claim the reliability and validity of the mathematical model is summarized in Table 1.

| Name of indicator | Value |

|---|---|

| 1. Correlation coefficient | 0.817 |

| 2. R2 | 0.667 |

| 3. Fisher’s criterion | 17.396 |

| 4. Critical Fisher’s value (for the probability of 0.95) | 3.002 |

| 5. Particular correlation coefficients: | |

| correlation coefficient for yx1 | 0.650 |

| correlation coefficient for yx2 | 0.418 |

| correlation coefficient for yx3 | 0.493 |

| correlation coefficient for x1x2 | 0.195 |

| correlation coefficient for x1x3 | 0.103 |

| correlation coefficient for x2 x3 | 0.184 |

The source: compiled by the authors

Table 1: Statistical parameters of reliability of the mathematical model.

As follows from the above data, the relationship between the value of the company and its degree of diversification along with the financial indicators is expressed by the number 0.817, i.e. it is a close one. Moreover, 66.74% of the value of the latter is determined by the dynamics of the factors included in the model; and this value is high. The relationship between the cost-to-assets ratio and the diversification degree is a close one (0.65). The model is also positively characterized by the fact that the mutual connection between the factors is low.

Next we test the statistical significance of the obtained equation on the basis of Fisher's test (F-criterion), and the determination coefficient.

Checking by the F-criterion

The research results have showed that the actual value of Fisher's criterion is equal to 17.396. The critical Fisher’s value (Fcrit), provided that the degree of freedom of the numerator f1=3 and the denominator f2=26, is equal to 3.002 [21] (the significance level α=0.05). The actual value of Fisher's criterion is greater than the critical value for the probability of 95%, which confirms a high degree of adequacy of the model.

Checking the determination coefficient

In this case, it is necessary to compare the actual value of the determination coefficient to the critical one. If the actual determination coefficient is greater than the critical one, then the regression model is significant. According to the study results, the actual value of the determination coefficient is 0.667. The table for testing at the significance level of 5% in the case of the sample n=30 and the number of variables k=3 yields the critical value R2crit=0.256. The actual value of the determination coefficient is greater than the critical one, which indicates the significance of the regression model.

Based on the foregoing, it can be argued that the obtained economic-mathematical model proves a possibility of increasing the value of a company by increasing the degree of diversification of the company (first of all), the return on assets on the gross profit and the operating profit margin of sales. It can be used for prediction and further analysis.

The study results have revealed a significant positive impact of the degree of diversification of the company on its value along with the financial-economic indicators. In the study, a statistically significant correlation has been revealed between the degree of diversification of the company and its autonomy coefficient (-0.719).

The negative feedback can be explained by the fact that, to provide their activity, companies need funding, the source of which is very often the long-term borrowings. It is the increase in the borrowed funds that results in reducing the autonomy coefficient of the company.

After identifying the correlation between the indices, we conduct a regression analysis of their interaction and write the regression equation (4):

![]() (4)

(4)

where y2 is the autonomy coefficient of the company;

x1 is the diversification degree of the company;

0.546 is a regression coefficient;

-1.477 is a regression coefficient;

1.112 is a coefficient indicating the average value of the unaccounted factors.

The graph of dependence of the company’s autonomy coefficient on its degree of diversification is shown in Figure 1.

The dependence equation is polynomial, the actual Fisher’s value is 28.183, which is larger than the critical one (9.342 at the probability of 0.95). Hence, the determination coefficient is statistically significant, whereas the obtained model is statistically reliable and adequate.

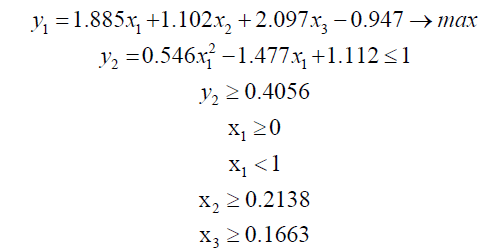

Based on obtained results, to determine the optimal diversification degree of the company, for which its maximum value is achieves and the financial stability is preserved, we compile the system of equations (5), keeping in mind the following criteria: the ratio of the company’s value to its assets should tend to the maximum; return on assets for gross profit must not be lower than the average value of the indicator over the companies in the sample; the return on sales for operating profit of the company must not be lower than the average value of the indicator over the companies in the sample; the autonomy coefficient of the company should be not smaller than the average value of the indicator over the companies in the sample and not greater than 1, and the degree of diversification can take values from 0 to 1.

Solving this system of equations using the function "Search for solutions" of MS Excel, we obtain the optimal degree of diversification of the company's business, which is equal to 0.6203 and at which its value reaches the maximum value, whereas the autonomy coefficient is above average for the investigated companies.

Despite the fact that diversification of the company’s activities has a positive impact on its value, one should be aware that it is impossible to infinitely expand the scope of activities. The negative consequences of such a strategy are: excessive expansion, lack of staff, the appearance of too many objectives and the conflict of corporate cultures, etc. In this regard, the task of the company’s management is to determine an optimal level of diversification of business, for which the company's activity is characterized by maximum efficiency.

(5)

(5)

where y1 is the ratio of the company’s value to the its assets;

y2 is the autonomy coefficient of the company;

x1 is the diversification degree of the company;

x2 is the return on assets of the company;

x3 is the company’s return on sales.

Thus, the research results have showed that, other things being equal, such companies have maximum efficiency that have a high degree of diversification of their activities.

Based on the obtained results, it is suggested to take into account the indicator of diversification in assessing the value of companies, allowing better and more accurately reflecting all the processes taking place in companies and affecting their activity indicators, assessing the value of companies in view of their diversification.

Capital asset pricing model (CAPM) by William Sharpe is one of the most common methods for determining the discount rate of cash flows of the company when assessing its value by the income approach. In this model, the discount rate is determined by the following formula:

![]() (6)

(6)

where R is the expected rate of return (%);

Rm is risk-free rate of return (%);

β is the systematic risk indicator, characteristic for the company;

Rf is average market profitability (%);

S1 is the premium for the size of a single company (%);

S2 is the premium for the risk of a single company (%);

C is the country risk (%).

The premium for the risk of an individual company (S2) reflects additional risks associated with investing in the company. In the calculation of this indicator, there are included such risks that have not been taken into account in the coefficient β and the premium for country risk (C). The main factors that are taken into account when calculating the premium for the risk of an individual company are: the quality of corporate management, dependence on key personnel, dependence on key suppliers, dependence on major customers.

The degree of risk of each factor is evaluated by the three-level scale: the low, medium and high one. When the risk degree is low, the factor is assigned one point; when it is moderate, two points; and for the high degree of risk, three points. Depending on the calculated values of the risk degree, the premium size for each company can assume any value from 0 to 5%.

It is proposed to include the degree of diversification of the company in the calculation of the premium for the risk of an individual company (S2) and use the following method for determining the value of its risk (Table 2).

| Diversification degree | Degree of risk | ||

|---|---|---|---|

| High | Medium | Low | |

| 0-0.5 | 3 | - | - |

| 0.5-0.75 | - | - | 1 |

| 0.75-1 | - | 2 | - |

Table 2: Estimation of the diversification risk of companies.

Due to the fact that the value of the optimum degree of diversification of the company’s business (0.6203) falls within the range from 0.5 to 0.75, it is proposed to assign such firms a low risk score equal to 1 point. Taking into account the positive impact of diversification on the company's value, and a negative correlation between the diversification degree and the autonomy coefficient, it is suggested to assign a medium degree of risk, corresponding to 2 points, to strongly diversified companies (the degree of diversification from 0.75 to 1). Finally, we propose to merge into a single group the non-diversified companies (0-0.25) and the companies having an average degree of diversification (0.25-0.5) and assign them a high degree of risk, which is equal to 3 points.

According to the proposed method, the risk premium of an individual company will be determined by five factors and can take the following values (Table 3):

| Degree of risk | Calculated value | Size of the premium (%) |

|---|---|---|

| Low | 1-1.6 | 0-1 |

| Medium | 1.8-2.2 | 2-3 |

| High | 2.6-3 | 4-5 |

Table 3: Premiums for the risk of an individual company.

• 0-1% – low degree of risk, where the arithmetic average of the calculated value of the five factors is 1-1.6 (total minimum value of the factors is 5, and the maximum, 8);

• 2-3% – medium degree of risk, with the calculated arithmetic mean value of the five factors is 1.8-2.2 (total minimum value of the factors is 9, and the maximum, 11);

• 4-5% – high degree of risk, where the calculated arithmetic average of the five factors is 2.6-3 (total minimum value of the factors is 13, and the maximum, 15).

Based on the research results, we consider it reasonable to use such a method of calculation, which involves using a five-factor assessment of the premium for the risk of an individual company instead of the four-factor assessment. This is necessary for comprehensive reflection of all the processes occurring within the company and affecting the indicators of its activity. The proposed method of calculating the discount rate of cash flows enables assessing the company's value taking into account its diversification and obtaining more accurate results reflecting the company's real value.

Copyright © 2025 Research and Reviews, All Rights Reserved