ISSN: 1204-5357

ISSN: 1204-5357

Department of Accounting, Covenant University, Ota, Ogun State, Nigeria

Isiavwe DavidGeneral Manager Union Bank of Nigeria Plc, Union Bank of Nigeria Plc., Nigeria

Adetiloye, Kehinde AdekunleDepartment of Banking and Finance, Covenant University, Ota, Ogun State, Nigeria

Eriabie, SylvesterDepartment of Accounting, Covenant University, Ota, Ogun State, Nigeria

Visit for more related articles at Journal of Internet Banking and Commerce

The preeminent objective of this paper is to ascertain the impact of financial statements on shareholdersâÃâÃâ¬ÃâÃ⢠investment decision making in Nigeria. We employed the use of well-structured questionnaire to elicit the perception of shareholders regarding the importance of financial statements for investment decision making and also their discernment of the adequacy of the content of financial statements. The two hypotheses formulated in the course of the study, were tested by the use of ANOVA test and the Likelihood Ratio Test, and otherwise referred to as G-test or maximum likelihood statistical significance test. The results of the empirical tests show that Stockholders do possess the requisite technical and professional skills to analyze IFRs financial Statement. And that Stakeholders in financial reporting in Nigeria do rely on the Financial Information disclosed in financial statements for investment decision making. We recommended inter alia that stakeholders should in addition to the accounting figures in the financial statement, compute ratio, trend and common size analysis in order to secure deeper information. Secondly, investors should not be unaware of the possibility of the use of creative accounting techniques by directors, in painting a distorted picture of the state of health of the reporting entities. Additionally, investors should be mindful of the fact that financial statements are historical in nature. Since the past do not always paint a perfect picture of the present or future, investors should in addition to financial statements analysis, investigate the internal and external environment of the reporting entities before arriving at a final investment decision.

Financial Report; Investors; Investment Decision

Financial statements are summaries of a company’s monetary value with which users of this information can make informed decisions for the present as well as for the future. In the word of, Edmonds, McNair, Milam and Olds [1], the central feature of external financial reporting is a set of financial statements. Financial statements are the primary means of communicating the information of an organization to the external users. Relatedly, According to Wild and Subramanyam [2], financial statements are to be prepared in accordance with GAAP, which are rules and guidelines of financial accounting. These rules determine measurement and recognition policies such as how assets are measured, when liabilities are incurred, when revenue and gains are recognized and when expenses and losses are incurred. They also dictate what information must be provided in the notes. The knowledge of these accounting principles is essential for effective financial statement analysis.

It is common knowledge that a vital function of management is to ensure that financial statements are prepared to show the true financial position of the company periodically to be used by stakeholders among which are shareholders or investors (both potential and active), Government, Employees, Financial Institutions, etc. However, the focus of this paper is shareholders. According to Oyinka [3], “A greater part of Nigerian investors both existing and potential, base their investment decisions on the performance of the company’s marketing and advertising strategies without considering the necessary documents provided by the company”.

The essence of this paper is to find out whether investors conduct proper analysis of financial statements before making their investment decisions. And also to find out whether investors understand the importance of the contents of financial reports and to ascertain if the financial statements so prepared by the directors of reporting entities, contain requisite information that can influence the decision of shareholders. Thus, the remaining part of this paper is classified into four sections as follows: Section 2 Literature Review and Hypothesis Formulation: Section 3 Method of data analysis; Section 4 Analysis of Findings and Test of Hypotheses; and section 5 Conclusion and Recommendations.

Accountants are Communicators

Accounting is the art of communicating financial message about a reporting entity to stakeholders such as shareholders, managers, employees, government, and regulatory authorities to mention but a few. The communication is generally in the form of financial reports that show in monetary denomination, the economic resources under the control of the management. The art is rooted in selecting the information that is relevant to the users and the ascertainment of its reliability. Shareholders need intervallic information that the managers are accounting properly for the resources under their control. This fact helps the shareholders to appraise the performance of the managers. This assessment of the accountant or directors of the reporting entities shows the extent to which the financial resources of the business have grown or diminished during the accounting period.

According to Ezejelue, “Financial Statement is described as the end product of the financial process”. The process is governed by prolific and often confusing and contradictory methods and Generally Accepted Accounting Standards (GAAP) which determine the input into the financial statement. Financial statements are periodical financial reports and accounts and other related documents that highlight the financial position of an enterprise as well as its profitability [4]. Financial reports also reveal the providers of the resources available to an enterprise and the extent to which such have been effectively utilized. According to Pillai [5] the True Blood Committee set up by the American Institute of Certified Public Accountants (AICPA), averred that the basic objectives of financial reporting was “to provide information that is useful in making economic decisions”. Also in 1975, the “Corporate Report”, Published by the Accounting Standards Steering Committee in the United Kingdom, asserted that the basic objective of financial reporting was “ to communicate economic measurements of and information about the resources and performance of the reporting entity useful to those having a reasonable right to such information”.

The figure below depicts a number of qualities that make accounting practice and financial reporting useful to stakeholders. Broadly, there are three major criteria used in evaluating the quality of financial reports, namely: (i) timeliness/availability of information, (ii) reliability, and (iii) comparability. According to FASB Concepts Statement No. 2 [6], relevance and reliability are two primary qualities that make accounting information useful for decision making. The FASB hierarchy started with the understandability of information. It explicitly states that benefits of information could be enhanced by making it extra understandable [6] and Cocker [7] (Figure 1).

Subject to constraints imposed by cost and materiality, increased relevance and increased reliability are the characteristics that make information more desirable commodity.

The Institute of chartered Accountant of India (ICAI) and International Accounting Standard Board (IASB), in their frameworks for the preparation and presentation of financial statements, have given the following main qualitative characteristics of Financial Statements:

1. Understandability

2. Relevance

3. Reliability

4. Comparability

The qualities were further classified into user specific qualities and primary decisions specific qualities.

User Specific Qualities

Decision makers and their characteristics: The information requirement of users varies from user to user. Thus, a fine equilibrium should be kept in revealing too much information or too little information. Similarly, disclosure of certain information to those who are already in possession of such information makes little relevance to them. If the recipient of the same could not comprehend certain information, it makes little contribution to the purpose at hand.

Understanding: The information provided through financial report may not be of much use unless the recipients are willing and able to study and use it. Financial reports should provide information understandable to all and should contain all relevant information required. Understandability of information is regularized by users’ characteristics and characteristics of information provided.

Primary Decision Specific Qualities

Relevance: The information provided should be logically related to the decision to be made. Information is relevant, if it can make a difference to the decision taken on knowing it. The information which is relevant for one decision may not be relevant for another. Relevant information reduces the uncertainty surrounding the predictions made by the decision-maker. To be relevant, information must be timely and have predictive value and/or feedback value.

Feedback value: This is the quality of the information to confirm the outcome of the predictions made in the past. According to Olujide [8], the soundness of past decisions affects future predictions. Feedback is the process of reporting information about the outcomes of that past decision to aid a decision maker in making decisions about the future.

Predictive value: Predictive value and feedback value go hand in hand. The future is a continuation of the past. The same information, which gives a feedback on past activities, will help in predicting the future. Without knowledge of the past, the basis for a prediction will usually be lacking. Without an interest in the future, knowledge of the past is sterile.

Timeliness: This is having information available to decision makers before it loses its capacity to influence decisions. Timeliness is an ancillary of relevance. If information is not available when it is needed or becomes available so long after the reported events that it has no value for future action, it lacks relevance and is of little or no use. Timeliness alone cannot make information relevant, but a lack of timeliness can fleece information of relevance it might otherwise have had. Timeliness does not make irrelevant information relevant but lack of it (timeliness) could convert relevant information to be irrelevant.

Reliability: The reliability of a measure rests on the faithfulness with which it represents what it purports to represent, coupled with an assurance for the user that it has that representational quality. To be useful, information must also be reliable. Information has the quality of reliability when it is free from material error and bias and can be depended upon by users to represent faithfully that which it either purports to represent or could reasonably be expected to represent. Reliability in accounting, encompasses two requirements, first, financial reports ought to be prepared on the basis of sound accounting rules. Second, adequate steps should be taken to ensure the compliance with the rules [9].

Accounting information is reliable so far as the depicted information represents the true economic setting of the business, which it is supposed to present. Reliability of accounting information arises from the two qualities of representational faithfulness namely, verifiability and neutrality.

Verifiability: This is to provide a significant degree of assurance that accounting measures represent what they propose to represent. The quality of verification helps to reduce measurer bias. It assures that the reported information represents what it purports to represent. Verifiability avoids both measurer bias and measurement biases. Measurer bias could be avoided by repeated measurement using the same measurement techniques.

Neutrality: This is the quality that information presented should be objective or unbiased, in that it should meet all proper user needs. The provider of the information should not be biased towards the needs of any one user group. Neutrality implies that in the formulation of accounting standards, the relevance of the information to the users should be the primary consideration than its impact on the interest of a particular user group. Thus, neutrality is lost when a particular result is desired and information is provided to attain that result.

Comparability: The third dimension of accounting quality is comparability. Comparability which speaks of consistency is an attribute that intermingles with relevance and reliability to impart on the usefulness of information. Comparability of financial information can be appraised from two standpoints. The first point of view of comparability is often ignored, especially in the case when financial reports are prepared according to similar standards. This facet relates to the need to understand the background significance of accounting information, such as fundamental environmental factors. The second viewpoint of comparability relates to the accounting policies used to prepare financial reports.

As has earlier been established, comparability includes consistency. “Consistency refers to the use of the same accounting policies and procedures, either from period to period within an entity or in a single period across entities”. It is therefore useful to mention that the mare fact that all these attributes are in place, does not assure the going concern of the organization. As Okoye and Enahoro [10] rightly posited, “Lapses of the management team cannot be highlighted in financial reports such as favoritism, marginalization, poor working capital management etc. This explains why many companies with unqualified audit reports collapse soon after huge profit figures have been reflected in their financial statements”.

To ensure that accounting information is reliable, Okoye [11] recommended that the following steps must to be embraced:

(1) In this era where nations are bedeviled with corruption, the need for strengthening forensic accounting is imperative so that appropriate sanctions are meted on the culprits.

(2) The militancy of trade unions and general dissatisfaction expressed by workers have highlighted the urgent need for Human Resource Accounting as an integral part of financial statement. Human resource has been recognized as the most vital asset of any organization.

(3) The current trend towards regional integration and globalization are very strong signals that every accountant must as matter of urgency understand the technicalities associate with International Accounting.

(4) Authorities behind the guidelines for preparation of financial statements e.g. NASB (now FRCN), Professional Accounting Bodies, NSE, CAMA etc. should sit up to ensure compliance to the standards and guidelines.

(5) Accounting Research is an inevitable element in improving the quality of accounting information generated for national economic development. Graduates and professional accountants should embrace research in any area of their choice with a view of enriching the information content of financial statements.

(6) The current crisis in some areas of our nation arose because no attention was paid to environmental issues over the years. Environmental accounting standard need to be put in place and meticulously enforced to appease the affected communities in particular and the nation at large.

Impact of IFRS Accounting Reports on Investors’ Decision

“Although accounting report should not in itself drive investment decisions, it is certainly one of the core sources of economic data that influences investment thinking”. Antill and Lee [12] in their article “Investment Implications of IFRS” focused on the entailments of IFRS for investors and decisions taken by investors in the condition of a new accounting standard. The authors continue their article with the analysis of different implications of IFRS and possible response of investors to these implications. The article reasons out that after the transition period of IFRS investors would be up to speed with the new standard and would definitely benefit from clear and standardized reporting. They would profit from investing overseas, especially. The second major advantage is that investors would bear relatively less risk than before. According to Ball [13], equity investors have five direct advantages from the implementation of IFRS:

Investors can benefit from more accurate, comprehensive and timely financial statement information of IFRS than of the local GAAP it replaces. When the financial statement information was not known from other sources this leads to better awareness in the capital markets and hence to lower risks for investors;

Small investors can reduce their risk when trading with more professional and better-informed investors, because the small investor is less capable in gathering information than a large investor;

Following IFRS leads to more comparability internationally. This reduces cost for investors because they do not need to analyze different accounting standards, to be able to compare the value of different equities;

The previously mentioned cost reduction increases market efficiency, resulting in better stock prices. Most investors are expected to gain from this increased efficiency;

Less accounting standard differences may result in growing cross-border acquisitions, rewarding investors to have better take-over premiums.

In the same article Ball [13] also notes some indirect advantages for investors from the IFRS introduction:

The transparency of IFRS reporting and higher quality disclosure pushes the agency costs between shareholders and managers down. Managers have more incentives to behave in the interests of shareholders;

More timely loss recognition could lower the costs of debt, resulting in a possible gain for equity investors (by reduction of the cost of debt capital);

One centering of thought is that the IFRS effect allows investors to forecast earnings in more precise manner because superior accounting standard makes reported financial statements better manifestation of a firm’s value. Another direction of a thought (a disadvantage for investors) is that managers’ intention to lower the unpredictability (by smoothing) of equity is not realized under a better accounting regime. IFRS earnings are more informative, but also more volatile, and therefore earnings forecasting is more difficult.

Hail and Leuz [14] put forward another argument that the potential effect of mandatory IFRS reporting may facilitate international investments and synergy of capital markets. The standardization of accounting rules simplifies the resolution for international investors to lay their money abroad. Such behavior of investors would lead to enlargement of investor stand and hence enhance risk sharing, enlarged liquidity and decrease of costs of capital [15]. According to Okafor and Ogiedu [3], the Framework for the Preparation and Presentation of Financial Statements describes the principles underling IFRS. A complete set of IFRS financial statements comprises: a statement of financial position (balance sheet) at the end of the period; a statement of comprehensive income for the period (or an income statement and a statement of comprehensive income); a statement of changes in equity for the period; a statement of cash flows for the period; and notes, comprising a summary of accounting policies and other explanatory notes.

In the event of any shareholders falling victim of any malpractice in the market, such a shareholder has recourse to market regulators including The Nigerian Stock Exchange and the Securities and Exchange Commission. According to Nowroozi [16], shareholder’s rights include the following: The right to secure methods of ownership registration; the right to convey or transfer shares; the right to obtain relevant company information on a timely and regular basis; the right to participate and vote in general shareholders meetings; the right to elect members of the board; the right to share in profits of the corporation; and the right to participate in and be sufficiently informed on decisions involving fundamental corporate changes.

Thus this paper is directed to testing the following hypotheses:

H01 Stockholders do not possess the technical and professional skills to analyze IFRS financial Statement

H02: Stockholders do not rely on the Financial Information disclosed in financial statements for investment decision making, due to its inadequacy.

Population, Sample and Sampling Technique

The population for this study comprises all investors in Nigeria listed companies. The sample size was 1000 shareholders made up of 500 academics and 500 non-academics staff of ten Universities in Lagos and Ogun states of Nigeria. The focus on universities’ community is rooted in the notion that those in the academic field tend to be more erudite about investments. Thus, we adopted stratified sampling technique.

Data Sources and Instrument for Data Gathering

The instrument of data collection that was employed by the researchers is the questionnaire. The questionnaire was based on close-ended questions designed to generate concise and clear-cut answers from the respondents. However some open-ended questions were used to get objective answers from respondents. Of the 1000 copies of questionnaire administered, 758 copies were returned, giving rise to external reject rate of 24.2%. Out of the 758 copies retrieved, only 712 were found usable. This amounts to 6.1% internal reject rate.

Analysis of Findings and Test of Hypotheses

In this section, we firstly, discussed the outcome of some questions in the measuring instruments that enabled us to test our two hypotheses.

The statement required respondents to rate their perception of the above statement under strongly agree, agree, neutral, disagree and strongly disagree which was coded 1 to 5 respectively. Therefore, Table 1 shows that all the 712 respondents answered to the question. The statement has a mean of 3.90 and a standard deviation of 1.214. This means that the mean of the data is closest to 4, that is, majority disagrees.

Table 1: Stockholders do not possess the technical and professional skills to analyze IFRs financial statement.

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| Stockholders do not possess the technical and professional skills to analyze, IFRs financial Statement | 712 | 1 | 5 | 3.9 | 1.214 |

| Valid N (list wise) | 712 |

Source: Field Survey 2017

Hypothesis 1

Hypothesis0: Stockholders do not possess the technical and professional skills to analyze IFRs financial Statement

Analysis whether Stakeholders in financial reporting possess the technical and professional skills to analyze IFRs financial Statement (Table 2).

Table 2: ANOVA Test.

| Sum of Squares | Df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|

| Between Groups | 29.61 | 2 | 14.805 | 5.261 | 0.006 |

| Within Groups | 540.308 | 710 | 2.814 | ||

| Total | 569.918 | 712 |

Source: Field Survey 2011

Level of significance 0.01; Calculated F-value 5.261; Tabulated F-value 3.04.

Decision: In relation to the first hypothesis as tested above, the calculated F-value is 5.261, using the level of significance of 0.05 or 5% and the tabulated F-value is 3.04 as obtained in the F-test table. On this basis, the alternative hypothesis is accepted in line with the proposition that Stockholders do possess the technical and professional skills to analyze IFRs financial Statement, while the null hypothesis is rejected. The level of significance generated by ANOVA is 0.006 and this is less than the level of significance which is 0.05, therefore it is significant.

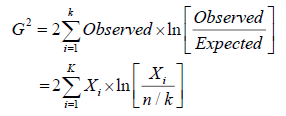

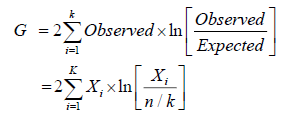

On the other hand, in testing our second (H2 ), which focused on whether Information content disclosed in IFRS financial statements is adequate for investment decision making or not. We employed the Likelihood Ratio Test otherwise referred to as G-test or maximum likelihood statistical significance test, and it is defined as:

Where:

G: Likelihood Ratio Test Statistics.

ln: Natural logarithm (log to the base of e).

x: Observed frequency.

n: Number of usable questionnaire.

Hypothesis 2

H0: Stakeholders do not rely on the Financial Information disclosed in financial statements for investment decision making, due to its inadequacy (Table 3).

Table 3: Information content disclosed in financial statements is not adequate for investment decision making.

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| Information content disclosed in financial statements is not adequate for investment decision making. | 712 | 1 | 5 | 3.68 | 1.325 |

| Valid N (list wise) | 712 |

Source: Field Survey 2017

The statement required respondents to rate their perception of the above statement under strongly agree, agree, neutral, disagree and strongly disagree which was coded 1 to 5 respectively. Therefore, the table shows all the 712 respondents responded to the question. Their response has a mean of 3.68 and a standard deviation of 1.325. This means that the mean of the data is closest to 4, that is, majority disagreed with the proposition (Table 4).

Table 4: Financial statements.

| S/N | Questions | SA | A | N | D | SD | |

|---|---|---|---|---|---|---|---|

| 9) | Financial statements are not examined by shareholders before making investment decisions | 25 3.5% |

39 5.5% |

52 7.3% |

258 36.2% |

338 47.5% |

|

| 10) | The information content disclosed in financial statements of a company are not adequate for investment decisions | 19 2.7% |

37 5.2% |

48 6.7% |

306 43% |

302 42.4% |

|

| 11) | Information content in financial statements does not really show the true and fair view of the financial status of a company | 13 1.8% |

25 3.5% |

32 4.5% |

412 57.9% |

230 32.3% |

|

| Total | 57 | 101 | 132 | 976 | 870 | Grand Total= 2,136 | |

| Composite score | 19 | 33.67 | 44 | 325.33 | 290 | Composite Score=712 |

Applying the G-Test:

Where:

G: Likelihood Ratio Test Statistics

ln: Natural logarithm (log to the base of e)

x: Observed frequency

n: Number of usable questionnaire.

G=2{57 × In (57/237.33)+101 × In (101/237.33)+132 × In (132/237.33)+976 × In (976/237.33)+870 × In (870/237.33)}=4530.42

There are three rows and five columns in our table, therefore our degrees of freedom (r-1)(c-1) is 8. Hence, at α=0.05, the tabulated value for 8 degrees of freedom=15.51. Since the calculated value is greater than the tabulated value, we hereby reject the null hypothesis in favor of the alternative and thus conclude that Stakeholders do rely on the Financial Information disclosed in financial statements for investment decision making.

The importance of the preparation of good quality financial statements by the directors of companies can never be over accentuated. Financial reports when properly prepared can be used in making very good investment decisions, for a country like Nigeria; this will boost the economy and subsequently result in a better society at large. When a patient for instance goes to the doctor for treatment, it is unlikely, that the doctor will start prescribing drugs to the patience without a prior medical examination/test. In a similar fashion, it is improper for investors (both potential and active) and analysts to form investment decision without obeying the diagnosis principles i.e. a critical analysis of Statement of Profit or Loss and other Comprehensive Income, Statement of Financial Position, Statement of Cash flow and other vital documents of the reporting entity. Thus, investing in a company without proper and critical analysis of the financial statements is akin engaging in gambling. However, with proper analysis of the financial reports, the investor is able to make clearer and more confidence decision.

Flowing from this study, we can conclude that a large sample of our population is literate enough to understand the dynamics of financial reports and actually examine financial statements before making investment decisions. Additionally, the information content of financial statements of companies are adequate for investment decisions. However, it is useful to note that no matter how conscientious and painstaking an analysis is, of financial reports, if the reports are window dressed, the decision arrived at will be suboptimal and misguiding.

Sequel to the Foregoing, the Following Recommendations are Important

1. Stakeholders should ensure that they do not invest in companies; based on their perceived net worth but they should subject the financial reports to detailed analysis, using tools such as ratio, trend and common size analysis.

2. Investors should not be unaware of the fact that many companies are using creative accounting techniques to disguise damaging information, to provide a distorted picture of the financial health of the business, and to smooth out unpredictable earnings. Thus investors should be on the lookout for specific indicators of potential problems or red flags such as: Downwards trends in earnings, increase in net income while operating cash flow is drifting downwards, disproportionate debts profile, switching auditors etc.

3. Useful as they seem, investors should be mindful of the fact that financial statements are historical in nature. Since the past do not always paint a perfect picture of the present or future, investors should in addition to financial statements analysis, investigate the internal and external environment of the reporting entities before arriving at a final investment decision.

4. There should be stiffer penalties meted out to companies that violate the financial reporting requirements and ethics. The enforcement unit of the Financial Reporting Council should be empowered to impose enhanced administrative sanctions against management of enterprises, auditors, and audit firms for violating accounting, auditing, and financial reporting requirements, with a view to misguiding investors.

5. Where in doubts, investors should seek the advice of a professional investment analyst(s) before investing in companies.

Copyright © 2024 Research and Reviews, All Rights Reserved