ISSN: 1204-5357

ISSN: 1204-5357

Departmement of Business Management, Sri Padmavati Mahila Visvavidyalayam (Women’s University), Tirupati-517502, India

Jayalakshmi M

Dept of Business Management, Sri Padmavati Mahila Visvavidyalayam (Women’s University), Tirupati-517502, India

Visit for more related articles at Journal of Internet Banking and Commerce

Digital adaptation started off as an option but has evolved into a necessity in every bank’s agenda around the globe as end-clients such as consumers, businesses, and governments are quickly adopting trends cascading from the technology sector in their IT capabilities, business operations, and business models. The present study focused on the Banking Digital transactions and its impact on the financial performance of public and private banking sector with reference to SBI and ICICI. The digital transactions such as ATM, NEFT, RTGS and Mobile transactions etc. are all remarkable landmarks in the digital revolution in the banking sector. Therefore, the study compares the Operational Profitability by the means of different parameters among two banking sector for the period 2016-17 and 2017-2018. In this study, we explore in-depth the digital phenomenon developing in the transaction banking landscape by identifying technology trends and changes as well as the impact of this digital transactions on the financial performance of the banking sector.

ATM Transactions; Banking Technology Index; Digital Transactions; Mobile Transactions; NEFT; RTGS

The Indian financial service sector continues to rapidly embrace digitization aided by the advent of new technologies and greater government push. Indian government has taken several steps to promote and encourage digital payment in recent past. The main aim of the government is to develop a digitally powerful economy, Faceless, Paperless, and Cashless as part of the Digital India campaign. Digital payments are of different types and modes. Some include the use of debit/credit cards, internet banking, mobile carriage services, digital payment apps, UPI, unstructured additional service data (USSD), bank pre-payment cards, mobile banking, etc. Total digital transactions in volume terms recorded a growth rate of 58.8 per cent during 2018-19, on top of a growth of 50.4 per cent during 2017-18, the Reserve Bank of India said in a report. By 2025, digital transactions in India could be worth $1 trillion annually, with four out of every five transactions being made digitally. Though the bulk of digital transactions in value terms (82.8 per cent) are accounted for by RTGS transactions, retail component of digital transactions (excluding RTGS customers and interbank transactions) witnessed a volume growth of 59.3 per cent during 2018-19, as against 50.8 per cent growth in the previous year. On an average, about 18-19 per cent of the GST collections, both in terms of value and volume, are received directly in government account through NEFT/RTGS payment modes, facilitating better cash management for the governments. Promotion of digital payments has been accorded highest priority by the Government and is one of the key highlights of the Union Budget 2017-2018. Accordingly, a pan-India target of total 2,500 crore digital transactions through five payment modes namely UPl, USSD, Aadhar Pay, IMPS and Debit cards, and GoI has achived target of 2060 Crore digital transactions durin FY 2017-18. New target of 110 Crore transaction has been assigned to department of Health and Family Welfare for FY 2018-19 and incentive schemes has been initiated for promotion of digital Payments. Hence, digital payment methods are often easy to make, comfortable, and allow flexibility from anywhere for customers to pay. Because of demonetization, people gradually began to accept digital payments, and even smaller businesses holders and shopkeepers began to accept digital payments. The digital revolution promises extraordinary gains in the productivity of the banking industry; dramatic improvements in the quality of customer experience; and a fundamental shift in the nature and intensity of competition. Both public and private sector banks have been investing heavily in the technology of future to stay relevant in a digitally connected world.

Banking industry is a backbone of Indian financial system and it is afflicted by many challenging forces. One such force is revolution of information technology. In today’s era, technology support is very important for the successful functioning of the banking sector. Technological innovation began in the Banking sector back in the 1980s. Technology has drastically improved the operational efficiency of the banking industry [1]. India has introduced a number of options to make fund transfers easy. Using Real Time Gross Settlement (RTGS), electronic instructions can be given to banks to transfer funds to another bank account. In this scenario the Indian banking sector will continue to grow, and digitization will continue. The pace of digitization of financial transactions in India continues to gather pace. It is estimated that the total payments transmitted via digital payment instruments will be in the range of USD 500 billion by 2020, which is approximately 10 times the current levels. Banking today is a flourishing industry, focused on technological innovation. Hence, internet banking has emerged as the biggest focus area in the “Digital Transformation” agenda of banks.

Need for the Study

The future of banking technology is e-banking or digital banking. The shift towards internet banking is fuelled by the changing dynamics in India. By 2020 the average age of India will be 29 years and this young consumer base is internet savvy and wants real time online information. Indian banks therefore need to aspire high and move toward implementing a world class internet banking capability. India’s banking industry is on the cusp of a major transformation, with new banking licenses expected to bring in more players in an already competitive environment. Further for achieving the operational Profitability, operational efficiency, meeting customer expectations and other parameters of banks’ performance, the role of employees and their efficient utilization cannot be undermined. The banking industry is going through a period of rapid change to meet competition, challenges of technology and the demand of end user. Clearly technology is a key differentiator in the performance of banks. Product innovation and development according to the needs of individual customers is the current buzzword. In such an environment, banks across India are increasingly adopting Technology to drive their overall profitability.

Scope of the Study

Technology has drastically improved the operational efficiency of the banking industry. india has introduced a number of options to make fund transfers easy. using Real Time Gross Settlement (RTGS), electronic instructions can be given to banks to transfer funds to another bank account. The indian banking sector will continue to grow, and digitization will continue. A growing economy would require good banking services and would automatically contribute to the positive future of banking industry.

Muhammad Shaukat [2] has described that the advances in IT have significantly influenced the radical changes of the twentieth century. This study examined the impact of IT on organizational performance with respect to different performance indicators of Pakistani manufacturing and banking sectors. The results of the research have led to the conclusion that IT has positive impact on organizational performance of all the organizations but the banking sector performance outstrips the performance of manufacturing sector.

Ekata [1], examined technological change, its relationship to firm size, and its impact on the efficient scale of output and product mix for large US commercial banks. The results suggest that technological change lowered real costs by about 1 percent per year, increased the cost minimizing scale of outputs, and affected product mix. To study the efficiency and productivity of banks, many researchers used DEA model [3]. Jani and Raval have made attempt to analyze employee's productivity with the use of financial ratio of business per employee and profit per employee in selected nationalized banks and give valuable suggestions findings for productivity improvement. Gupta in their study on 'productivity and performance of public sector banks in India' on the basis of Branch Productivity and Employee Productivity for the period of 1991-2010 Productivity suggested that banks need to improve their productivity apart to this improvements in profitability, maintain efficiency level and technology and exploring available Similarly, in banking industry productivity is defined as a cost-effective solutions. Suvitha [4] The mainobjective of this study is to compare the effect of IT on banks’ profitability with the marketing expenses. the study finds that IT expenses affects bank’s profitability and performance inbetter way compared to marketing expenses. Findings suggest that investment in IT can result in higher profitability for the banks as compared to marketing expenses. Thangam [5] study has analysed the productivity of nine banks, three banks each from PSB group, PVTB group and FB group. It takes into account net profits, deposits, advances, total interest income, total expenditure and total business of the selected banks as the measure of productivity. Yadav [6] describes, Indian banks have delivered a significant role in shaping the financial system and thereby facilitates for economic growth. The productivity of employees is crucial for the overall efficiency of the banks. The role of employees is also of great significance as each and every activity of a bank is directly related to the attitude, motivation and work culture of the employees. Hence, employee productivity becomes an important factor while measuring overall efficiency and productivity of banks.

Objectives of the Study

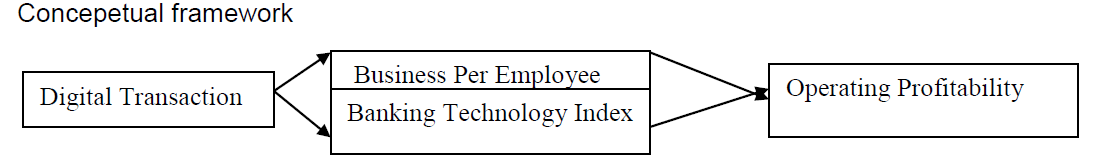

The main objectives of the study is to analyse and compare Operational Profitability with which by using four parameters such as Digital Transaction, Business Per Employee and Banking Technology Index among top two banking sector with reference to SBI and ICICI.

To analyse the Digital Transactions relationship between Business per Employee and operating profitability of the selected banks.

To analyse the digital Transactions impact of Banking Technology Index on business per employee and operating profitability of the selected banks.

Hypotheses of The Study

H0: There is no relationship between digital transactions and business per employee with operating profitability of the banking sector.

H0: There is no relationship between impact of Banking Technology Index and business per employee with operating profitability of the banking sector.

The data for the present study is purely seconadary data. The secondary data and information have been collected from the publications of the Reserve Bank of India: ‘Report on Trend and Progress of Banking in India’, ‘Handbook of Statistics on Indian Economy’, ‘RBI Bulletin (monthly)’, Annual Reports of respective banks and other valuable publications of public and private sector banks. Data obtained reports related to balance sheet and Profit/Loss were obtained for the year 2016-17 and 2017-18. The data collected for the study have been analysed by using appropriate statistical tools, Bivariate correlation of coefficient and Ordinary Least Square test.

Summary statistics, digital transaction have a significant relationship between Business per Employee and Banking Technology Index with operating Profitability of the Banking sector [7-11].

The financial performance of a bank can be measured in a number of ways. The Operational Profitability is the most widely used indicator to judge the financial position of a business.

Technology Index of a Bank=[(Number of ATMs/Total Branches)+(NEFT/Total Branches)+(RTGS/Total Branches)+(Mobile Banking/Total Branches)] × 100.

Bivariate Correlation: Biviriate correlation analysis which is a statistical tool to describe the degree to which one variable is linearly related to another. It explores the concept of relationship between two variables, More specifically, bivariate analysis explores how the dependent (“outcome”) variable depends or is explained by the independent (“explanatory”) variable (asymmetrical analysis), or it explores the association between two variables without any cause and effect relationship (symmetrical analysis). In the present study, to better investigate the above preliminary evidences and to gain a deeper understanding of the relationship between Banking Technology Index and Operating Profitability, the set of regressions have been estimated.

Ordinary least square: Ordinary least squares regression (OLSR) is a generalized linear modeling technique. The regression model can be used to describe the relationships between two or more variables in a sample without making any assumptions except that the dependent variable is continuous and that the relationships between these variables are linear. As a result, regression models can be used almost anytime in a purely descriptive manner to summarize the relationships between the variables in a sample.

Economic Variables for the Study

NEFT

RTGS

ATM Transactions

Mobile transaction

Objective 1: Relationship between Business per Employee and operating profitability of ICICI Bank and SBI bank

H0: There is no significant relationship between Business per Employee with Operating Profitability of banking sector.

To analyze the relationship between Business per Employee with its Operational Profitability the Bivariate correlation has been adopted. It may observed from Table 1 that the Digital Transactions of the ICICI Banking sector such as ATM, RTGS, NEFT and Mobile transactions 0.825, 0.982, 0.929 and 0.822 are indicated positive and strongly correlated with Business per Employee but the relationship between Operating Profit indicated that ATM 0.0693 has a positive significant relationship whereas NEFT, RTGS and Mobile transaction -0.968, -0.903 and -0.783 are shown a negative relationship. Further, p-value observed to be less than 0.05 hence, null hypothesis is rejected. Moreover the Digital Transactions of the SBI banking sector Such as ATM, RTGS, NEFT and Mobile Transactions 0.835, 0.87, 0.999*, and 0.922 are shown positive and strongly correlated with Business per E employee but the relationship between operating profitability indicated that ATM 0.682 has positive significant relationship and NEFT, RTGS and Mobile Transactions -0.997 -0.853 -0.981 has shown a negative correlation with operating profitability. Further, p-value observed to be less than 0.05. Hence, null hypothesis rejected.

| Economic Variables | ATM | NEFT | RTGS | MOBILE | |

|---|---|---|---|---|---|

| ICICI | |||||

| Business Per Employee | Pearson Correlation | 0.825 | 0.982 | 0.929 | 0.822 |

| Sig. (2-tailed) | 0.003 | 0.012 | 0.042 | 0.006 | |

| N | 3 | 3 | 3 | 3 | |

| Operating Profitability | Pearson Correlation | 0.693 | -0.968 | -0.903 | -0.783 |

| Sig. (2-tailed) | 0 | 0.001 | 0.003 | 0.002 | |

| N | 3 | 3 | 3 | 3 | |

| SBI | |||||

| Business Per Employee | Pearson Correlation | 0.835 | 0.870 | 0.999* | 0.922 |

| Sig. (2-tailed) | 0.051 | 0.005 | 0.026 | 0.053 | |

| N | 3 | 3 | 3 | 3 | |

| Operating Profitability | Pearson Correlation | 0.682 | -0.997 | -0.853 | -0.981 |

| Sig. (2-tailed) | 0.002 | 0.048 | 0.049 | 0.023 | |

| N | 3 | 3 | 3 | 3 | |

Source: Secondary Data

Table 1: Relationship between Business per Employee with Operating Profitability.

H0: There is no significant influence of Banking Technology Index on its Business per Employee of ICICI bank.

Above Table 2 Ordinary least square test shows that Banking Technology Index’s coefficient value is 3.1613109, which means ICICI Banking Technology Index is having positive influence on Business per Employee and it is observed that the p-value is less than 0.05, hence, null hypothesis rejected, that means there is a significant influence of ICICI’s Banking Technology Index on Business per Employee.

| Dependent Variable: BPEICICI | ||||

| Method: Least Squares | ||||

| Sample: 1 8 | ||||

| Included observations: 8 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 8.9377475 | 4.528542 | 19.73648 | 0.0000 |

| TI ICICI | 3.1613109 | 6.973991 | 4.533001 | 0.0040 |

| R-squared | 0.773995 | Mean dependent var | 1.047808 | |

| Adjusted R-squared | 0.736328 | S.D. dependent var | 18059135 | |

| S.E. of regression | 9273191. | Akaike info criterion | 35.13547 | |

| Sum squared resid | 5.160000 | Schwarz criterion | 35.15533 | |

| Log likelihood | -138.5419 | Hannan-Quinn criter. | 35.00152 | |

| F-statistic | 20.54810 | Durbin-Watson stat | 1.186172 | |

| Prob (F-statistic) | 0.003963 | |||

Source: Secondary Data.

Table 2 : Impact of ICICI Banking Technology Index on Business per employee.

H0: There is no significant influence of ICICI Banking Technology Index on its operating profit.

Above Table 3 Ordinary least square test shows that ICICI Banking Technology Index’s coefficient value is 1.059735, which means the ICICI Technology Index is having the positive influence on Operating profitability. Further, the p-value is observed to be greater than 0.05 hence, null hypothesis accepted that means there is no significant influence of ICICI Banking Technology Index on its Operating Profitability.

| Dependent Variable: OPICICI | ||||

| Method: Least Squares | ||||

| Sample: 1 8 | ||||

| Included observations: 8 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob |

| C | -2.022192 | 1.001541 | -2.019081 | 0.0900 |

| TIICICI | 1.059735 | 1.542381 | 0.687078 | 0.5177 |

| R-squared | 0.072940 | Mean dependent var | -1.547500 | |

| Adjusted R-squared | -0.081570 | S.D. dependent var | 1.972024 | |

| S.E. of regression | 2.050876 | Akaike info criterion | 4.486729 | |

| Sum squared resid | 25.23656 | Schwarz criterion | 4.506589 | |

| Log likelihood | -15.94692 | Hannan-Quinn criter. | 4.352779 | |

| F-statistic | 0.472076 | Durbin-Watson stat | 0.704379 | |

| Prob(F-statistic) | 0.517695 | |||

Source: Secondary Data

Table 3: Impact of ICICI Banking Technology Index on Opearting Profitability.

H0: There is no significant influence of SBI Banking Technology Index on its Business per Employee.

Above Table 4 Ordinary least square test shows that SBI Banking Technology Index coefficient value is 3.369694, which means SBI Technology Index is having a positive influence on Business per Employee and p value is observed to be less than 0.05, hence, null hypothesis rejected which means there is a significant influence of SBI Banking Technology Index on its Business per Employee.

| Dependent Variable: BPESBI | ||||

| Method: Least Squares | ||||

| Sample: 1 8 | ||||

| Included observations: 8 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 9.2155147 | 1.05288 | 8.752604 | 0.0001 |

| TISBI | 3.369694 | 7.556317 | 4.459440 | 0.0043 |

| R-squared | 0.768220 | Mean dependent var | 1.278208 | |

| Adjusted R-squared | 0.729590 | S.D. dependent var | 38233227 | |

| S.E. of regression | 19881649 | Akaike info criterion | 36.66081 | |

| Sum squared resid | 2.3700000 | Schwarz criterion | 36.68067 | |

| Log likelihood | -144.6432 | Hannan-Quinn criter. | 36.52686 | |

| F-statistic | 19.88661 | Durbin-Watson stat | 1.085960 | |

| Prob(F-statistic) | 0.004286 | |||

Source: Secondary Data.

Table 4: Impact of SBI Banking Technology Index on Business per Employee.

H0: There is no significant influence of SBI banking technology index on its operating profit.

The Above Ordinary least square test Table 5 shows that Banking Technology Index’s coefficient value is -6.38005, which means SBI Technology Index is having a negative influence on Operating Profitability and the p value observed to be less than 0.05. hence, null hypothesis rejected which means there is a significant influence of SBI Banking Technology Index on its Operating profitability.

| Dependent Variable: OPSBI | ||||

| Method: Least Squares | ||||

| Sample: 1 8 | ||||

| Included observations: 8 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -2.709018 | 1.783047 | -1.519319 | 0.0095 |

| TISBI | -6.38005 | 1.280005 | -4.985701 | 0.0025 |

| R-squared | 0.805556 | Mean dependent var | -9.327500 | |

| Adjusted R-squared | 0.773149 | S.D. dependent var | 7.069069 | |

| S.E. of regression | 3.366920 | Akaike info criterion | 5.478192 | |

| Sum squared resid | 68.01692 | Schwarz criterion | 5.498052 | |

| Log likelihood | -19.91277 | Hannan-Quinn criter. | 5.344242 | |

| F-statistic | 24.85722 | Durbin-Watson stat | 1.426482 | |

| Prob(F-statistic) | 0.002488 | |||

Source: Secondary Data.

Table 5: Impact of SBI Banking Technology Index on Operating Profitability.

1. The study result reveals that the digital transactions strongly correlated with Business per Employee of ICICI and SBI.

2. The study indicated with the bivariate correlation that the NEFT, RTGS and Mobile Transactions are having the negative relationship with the Operating profitability of the ICICI bank and SBI.

3. The study found, with the ordinary least square method that the impact of technology index of ICICI bank (3.16131) is having the significant impact on the Business per employee but on operating profitability is not having the significance impact.

4. The study found, with the ordinary least square method that the impact of technology index of SBI bank (3.369) is having the significant impact on the Business per employee and on operating profitability (-6.38005) having the negative influence.

In the development of Indian Economy, Banking sector plays a very important and crucial role. With the use of technology there had been an increase in penetration, productivity and efficiency. Banking is an integral part of financial activity today and digital banking in India is highly advanced. The study focused on the Banking technology impact on financial performance of public and private banking sector. It has been considered the banking digital transactions of ATM, NEFT, RTGS and Mobile Transactions of the SBI from the public and ICICI bank of Private sector banks and their technology index has been designed with the help of the digital transactions and measured the relationship of the banking technology with the operating profit and the business per employee. Technology is going to hold the keys to future of banking. So banks should try to find out the trigger of change. Indian Banks need to focus on swift and continued infusion of technology. However there is need for an education drive both for the customers as well as the merchants so that proliferation of digital payments to increase operational profitability of the sector.

Copyright © 2025 Research and Reviews, All Rights Reserved